Hello, I am Advocate Brownie Ebal

I am a legal Practitioner, Venture Capitalist and Philanthropist.

Welcome to my site.

I love life, travelling, food, beauty, the law, leadership and meeting people from diverse backgrounds. I hope to inspire each one of you with my various articles as I share from my experiences around our beautiful world.

I live in Kampala, Uganda.

-

Article 34: Addressing Gender Bias in the Professional Women for Water and Sanitation (PW4WATSAN) Sector.

Written by Brownie Ebal and Nakiyimba Victoria.

Gender bias remains a persistent challenge across sectors, including water and sanitation (WATSAN). The recent PW4WATSAN Meet-Up, under the theme “Addressing Gender Bias in the PW4WATSAN Sector,” brought together thought leaders to share insights on fostering equity, leadership, and influence among women. This article captures the key lessons and strategies discussed, with a focus on actionable steps for lasting change.

Leadership and Influence: Insights from Hon. Miria Matembe

Hon. Miria Matembe emphasized that leadership is not about holding a position but about creating meaningful influence. Women, as unique creations of God, possess the ability to nurture life, lead intellectually and shape the world spiritually.Her practical advice included:

- Knowing Yourself: Women should develop a strong sense of identity, recognize their value, and embrace their strengths and weaknesses.

- Defining Purpose: Women must understand their vision, calling, and talents, allowing these to guide their actions and goals.

- Being Intentional: Living with integrity, character, and excellence ensures that women leave a legacy of positive influence.

Quoting Isaiah 49:1-3, Matembe reminded participants of their divine purpose, urging them to bear fruits that last and to be fearless in pursuing their mission.Challenging Gender Stereotypes: Mr. Frank Fayo Nyakahuma’s Perspective.

Mr. Frank Fayo Nyakahuma highlighted how entrenched societal stereotypes like “That guy behaves like a woman” or “She’s acting like she’s on her period” perpetuate gender bias. These harmful narratives stem from societal and parental roles that require deliberate change.To dismantle these biases, Frank emphasized:

- Owning the Change: Individuals must take responsibility for reshaping attitudes and challenging limiting beliefs.

- Embracing Continuous Learning: Knowledge is key to breaking barriers and developing inclusive mindsets.

- Building Strong Networks: Connections foster collaboration and mutual empowerment.

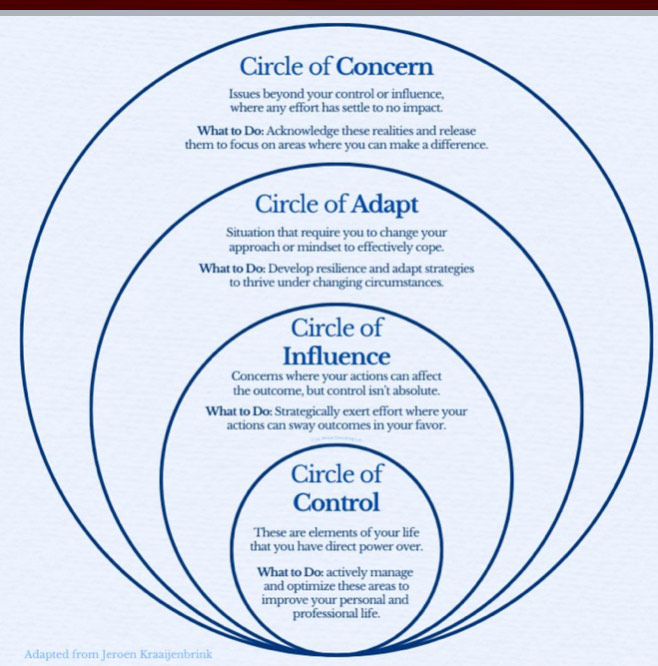

Circle of Influence: Managing Challenges Effectively

In his presentation, Frank also introduced the Circle of Influence framework to help individuals navigate challenges in a biased environment:

- Circle of Concern: Acknowledge issues beyond your control and avoid wasting energy on them.

- Circle of Adapt: Adjust your mindset and strategies to cope with situations that require flexibility.

- Circle of Influence: Focus efforts where you can sway outcomes and make a meaningful difference.

- Circle of Control: Actively manage the aspects of life within your direct power to foster personal and professional growth.

Practical Strategies from the Panel Discussion

The panel discussion offered practical advice for women navigating gender bias:- Define Your Value: Understand and assert your worth.

- Be Bold and Courageous: Draw strength from Joshua 1:9 to confront challenges head-on.

- Ignore Negativity: Block out distractions and focus on achieving your goals.

- Read the Room: Cultivate emotional intelligence to navigate different

environments effectively.

In conclusion, addressing gender bias in the PW4WATSAN sector requires intentional efforts to empower women, challenge societal stereotypes, and foster inclusive environments. As highlighted by Hon. Miria Matembe, leadership is about influence, not position, and women must recognize their value, embrace their purpose, and strive for excellence to leave a lasting

legacy. Mr. Frank Fayo Nyakahuma urged participants to own the change by challenging limiting beliefs, building strong networks, and focusing on areas of influence and control to drive progress. By knowing ourselves, redefining gender narratives, and working collaboratively, we can transform the sector into a model of equity and inclusion. Let us commit to these principles

and actively champion change, creating a future where everyone can thrive.

-

Article 33: National Water and Sewage Corporation’s Leaders are Learners Club (NWSC-LLC) Hosts Inaugural Writers Workshop to Enhance Writing Skills, Data Presentation and Drive Corporation Growth.

Written by Josephine Lunkuse.

In today’s corporate environment, the ability to effectively write documents, concept papers and research reports is crucial to driving business success and ensuring the sustainability of an organization. As marketing continues to evolve, it is increasingly important to communicate ideas clearly and persuasively to stakeholders. To support career growth and improve literacy in the workplace, the NWSC-LLC hosted its inaugural writers’ workshop at Jinja Road offices yesterday.

The session, led by Dr. Eng. Martin Kalibbala, Manager of Training and Capacity Development, provided valuable insights into crafting well-structured research reports. Participants were guided through the key components of a good research paper, including how to write an abstract, introduction, background of the study and objectives. Dr. Kalibbala emphasized that a research report should be divided into clear chapters such as introduction, methodology, appendices. He stressed the importance of clarity, simplicity and avoiding overly complex terminology adding that the abstract should range from 150 to 200 words.

Additionally, he highlighted the significance of choosing the appropriate research methodology, whether qualitative or quantitative and the importance of sourcing valid information and quoting accurately. He concluded with a reminder about the critical need for cross-verification of data to ensure its accuracy. The team left the workshop with practical knowledge that will undoubtedly enhance their ability to write impactful research reports.

In an interview with Brownie Ebal, President of the NWSC-LLC, she noted that the workshop had been invaluable in shaping the team’s approach to preparing abstracts for Uganda Water Week and papers for the International Water Association (IWA).

As the saying goes, knowledge is power, through this workshop, the NWSC-LLC has strengthened its ability to effectively communicate complex ideas, paving the way for better expression of their concepts.

-

Article 32: Invest in Women, Accelerate Progress: Insights from the 11th Annual Women in Business Leader’s Conference.

On Thursday, 28th November 2024, the Uganda Women’s Entrepreneurs Association Limited (UWEAL) held the 11th Annual Women in Business Leaders’ Conference, bringing together inspiring voices to explore the theme “Invest in Women: Accelerate Progress.” The event began with remarks from Sarah Kitakule, Chairperson of the UWEAL Board, who highlighted the pivotal role women play in Uganda’s economy. She noted that 40% of SMEs are owned by women, positioning Uganda third globally in this regard. However, she posed a critical question: Are women truly thriving?

With 80% of women operating in the informal sector, Sarah stressed the untapped potential of women in Uganda. She noted that empowering women economically could have a ripple effect, benefiting society at large. Women are more likely to invest in their homes and families, prioritize household welfare, and improve nutrition and feeding practices within their

communities.

Sarah Kitakule concluded her remarks by urging participants to move beyond discussions and ensure the conference delivers meaningful actions that empower women and accelerate progress.Annette Kiconco, Chief Retail Banking Officer of DFCU Bank, emphasized the institution’s unwavering commitment to supporting women entrepreneurs through customized credit solutions and growth-oriented initiatives. She pointed out DFCU’s efforts to help women formalize their businesses, unlocking access to broader opportunities and sustainable success.

A notable example is the bank’s Kyadondo Center, a dedicated hub for women entrepreneurs. Beyond financial services, the center offers essential knowledge and skills to help women thrive in their ventures. Annette reaffirmed DFCU’s dedication to creating an enabling environment for women-led businesses to flourish. Please visit: https://www.dfcugroup.com/dfcu-

services/dfcu-women-in-business/ for more information about the initiatives.The first panel discussion featured Alex Asiimwe, Commissioner from the Ministry of Gender, Labour, and Social Development, and Hellen Alobo, Gender Specialist from CARE International Uganda, addressing challenges and opportunities for women’s economic empowerment.

Alex emphasized the legal protections provided under the Constitution, citing Articles 33 and 40, and urged women to use these as a foundation for advocacy. He also highlighted the government’s GROW Program, which offers financial support through secured loans and capacity building via financial literacy and digital skills training. While concerns were raised

about limited availability of GROW funds, Alex reassured attendees that additional funding was underway and encouraged women to stay in touch with their banks. For more on the GROW

Program, visit: https://www.uweal.co.ug.Hellen shed light on cultural barriers, such as limited access to land, male-dominated financial decision-making, and restricted use of mobile phones for business. She explained how CARE International works with families and communities to redistribute unpaid domestic work and raise awareness among men and boys about shared responsibilities. By collaborating with

cultural leaders, CARE challenges norms that hinder women’s progress and creates a more supportive environment. Learn more about CARE’s initiatives here: https://www.care.org.The panel concluded with a collective call for stronger collaboration among government, communities, and organizations to foster an inclusive environment where women entrepreneurs can thrive.

The second panel discussion featured speakers from Housing Finance Bank, Agile Media Africa, and the petroleum sector, offering practical strategies for women entrepreneurs to grow their businesses while driving sustainable development.

Transitioning from firewood and charcoal to gas was identified as a crucial step for sustainability. Gas, being cost-effective and environmentally friendly, reduces household expenses and conserves resources. This shift also presents a promising business opportunity for women to venture into gas distribution and tap into this expanding market. Women interested in

exploring this opportunity can find guidance and support through relevant programs.Housing Finance Bank’s Harold Grace Muzira introduced the Zimba Mpola Mpola Program, which now extends beyond mortgages to provide flexible financing tailored to individual income flows. Women with land who want to build can access incremental loans, helping them overcome challenges like limited land ownership, financial constraints, and literacy gaps. For

more details, visit: https://www.housingfinance.co.ug.From Agile Media Africa, Aggie Patricia Turwomwe highlighted the importance of brand identity and authentic storytelling for business growth. She encouraged women to leverage social media platforms like TikTok and Instagram to share their stories, noting that consistency and quality content could help them attract meaningful engagement, regardless of follower count.

In conclusion, the 11th Annual Women in Business Leaders’ Conference 2024 highlighted the significant role women play in driving Uganda’s economy while addressing key challenges such as cultural norms, limited resources, and language barriers. Practical solutions like the GROW

Program, Housing Finance’s Zimba Mpola Mpola initiative, and digital tools for branding were emphasized as pathways to progress.The conference reinforced the need for collaboration among government, private sector, and development partners to create an environment where women entrepreneurs can thrive. Investing in women is a direct investment in progress, paving the way for a more inclusive and prosperous

society.

-

Article 31: Empowering the New Year: MS. Betty Ogiel’s Key Lessons on Resilience at NWSC-LLC Fellowship

Written by Josephine Lunkuse

Yesterday, the NWSC-LLC hosted the global inspirational speaker and resilience coach, Ms. Betty Ogiel, at their 23rd fellowship. The event, themed “Harnessing the Power of Resilience as One Steps into the New Year,” was an empowering session that left a lasting impact on attendees. Ms. Ogiel began her speech by defining resilience as the ability to recover from difficulties and adapt to new challenges. She elaborated on the different types of resilience, including emotional, physical, mental, social, spiritual and financial resilience. She explained that to successfully manage and cultivate all these forms of resilience, individuals must embody three core attitudes of learning that is overcoming the I know everything attitude, adopting a humble and open mindset that values learning from others and embracing a teachable spirit, acknowledging that personal growth comes from being receptive to guidance.

She went on to introduce several key pillars of resilience that everyone should practice to build strength and fortitude in their lives. These pillars include self-awareness, flexibility, building strong and supportive relationships, staying motivated and prioritizing self-care. She then highlighted the importance of resilience in navigating life’s challenges, noting that it helps individuals anticipate change, turn setbacks into comebacks and align their personal goals with their professional aspirations. Ms. Ogiel encouraged the attendees to approach 2025 with strategic foresight, cultivating a growth mindset, practicing gratitude, setting realistic goals and building emotional agility.

A critical part of her message was the importance of focusing on the positives. Reiterating the FOCUS framework, she urged everyone to channel their energy toward what uplifts them and propels them forward, no matter the obstacles they may face. Ms. Ogiel closed her speech by encouraging the audience to see challenges as opportunities for growth. She reminded them to remain strong, stay resilient and always aim higher in life, regardless of the hurdles that may come their way.

On behalf of the NWSC-LLC, Ms. Brownie Ebal extended the teams’ gratitude to Ms. Ogiel for sharing her invaluable insights adding that her words have set the tone for the team as they embark on making 2025 a year of winning, growth and monumental achievements.

For more information on Betty’s work. kindly visit her website:

About Me

I love reading, writing, attending events, learning, leadership and meeting new people.

I hold a Masters Degree in International Law and I am passionate about life.

If you are interested in learning more about self discovery and becoming the best version of yourself.

Follow Me On

Subscribe To My Newsletter

Subscribe for new stories and exclusive content.