Hello, I am Advocate Brownie Ebal

I am a legal Practitioner, Venture Capitalist and Philanthropist.

Welcome to my site.

I love life, travelling, food, beauty, the law, leadership and meeting people from diverse backgrounds. I hope to inspire each one of you with my various articles as I share from my experiences around our beautiful world.

I live in Kampala, Uganda.

-

Article 30: Luzira Branch Hosts Legal Aid Clinic to Tackle Debt Management

Written by Sheila Wangutusi.

On 10th January 2025, Kampala Water’s Luzira Branch hosted a Legal Aid Clinic aimed at addressing arrears and enhancing staff knowledge on debt management. The exercise led by Principal Legal Officer, Advocate Brownie Ebal brought together the branch team and legal experts to explore solutions for debt recovery and prepare for an upcoming bad debt write-off initiative.

The Sub-Branch Manager, Mr. Peter Lugai, presented an overview of the branch’s water sales and collection status during which he emphasized the importance of such initiatives in equipping the team with strategies to manage debts effectively, particularly in identifying accounts eligible for bad debt write-offs.

During the clinic, the legal team tackled key challenges, including how to handle difficult customers and assess accounts for write-off eligibility. Notably, over 90 demand notices, totaling over UGX 62 million, were issued to defaulters.

Ms. Ebal provided detailed insights into the Bad Debt Policy, outlining categories of accounts eligible for write-offs, such as insignificant debts, rejected bills, demolished sites, and abandoned properties. She also clarified the necessary documentation for each case, to ensure compliance with NWSC’s guidelines.

Beyond debt recovery, the clinic offered alternative dispute resolution mechanisms, which would allow for customers to avoid costly legal processes while resolving their concerns. This approach has strengthened debt recovery efforts in the past and also improved staff understanding of NWSC’s governing laws and policies.

The clinic is one of KW’s broader strategy to combat water theft, illegal usage, and ofcourse aid in arrears reduction. Crackdowns on defaulters, coupled with opportunities for reconnection to supply on a percentage payment, have fueled all round customer trust, loyalty customer relations.

-

Article 29: Financial Transformation for Women: Managing Personal Finances, Investment and Safety Nets

Representatives of Powerhouse Investment Club who attended the event. Written by Adv. Brownie Ebal

In today’s unpredictable world, financial transformation is more than just a goal—it is a necessity. For women, understanding and managing finances is key to building stability, independence, and a secure future. It begins with simple yet deliberate steps: gaining knowledge, saving, investing wisely, and establishing safety nets to protect against life’s uncertainties.

Financial literacy, the skill and knowledge to manage money well, is the foundation. Surprisingly, 85% of financial success is based on behavior and attitude rather than income alone. This means prioritizing resources, cultivating savings habits, and adopting a healthy relationship with money. Yet the statistics are sobering only 1% of people save for retirement, 2% of Ugandans have UGX 10 million or more at any given time, and 8.3 million Ugandans struggle daily to secure their next meal. These realities highlight the urgent need for women to take control of their finances, not only for themselves but also for their families.

Saving remains the first step toward transformation. An emergency fund—accessible and ready—can ease life’s unexpected burdens. Beyond saving, women must also focus on investments that create long-term value. Whether through agriculture, small businesses, or SACCOs, finding opportunities that align with market demands is essential. Skills and talents can also be monetized. Ask yourself: What am I good at, and how can I commercialize it? From baking to digital services, every ability holds the potential for income.

However, financial stability extends beyond money. A woman’s overall well-being—mind, body, and spirit—plays a significant role. Health is non-negotiable. Regular medical check-ups such as annual pap smears, mammograms, and PSA screenings for men are critical for early detection of health issues. Proper rest, physical activity, and emotional balance form the foundation for resilience. Engaging with children, spending quality time with them, and guiding them with values helps build a financially responsible future generation. Involving children in physical activities and meaningful conversations equips them with the tools to thrive.

Family dynamics and planning are equally vital. Concepts like the “5-Jar Approach,” used in Jewish households, teach the importance of dividing resources for savings, giving, spending, investing, and emergencies. Such habits, if passed down, ensure that financial responsibility becomes a family legacy.

Financial transformation is about taking small but significant steps today—saving consistently, managing debt wisely, investing for the future, and planning for transitions, including retirement. It is about creating safety nets through insurance, long-term financial plans, and the discipline to stick to them.

At its heart, the journey toward financial empowerment is deeply personal, yet its impact is far-reaching. Women who take control of their finances build not just their own futures but also resilient families and communities. By prioritizing our health, engaging with our loved ones, and managing our resources with intention, we can break cycles of financial hardship and pave the way for a brighter, more secure tomorrow.

Financial transformation begins with you. The steps you take today will secure your future and light the path for generations to come.

For more information on the Female Future Leadership Programme, kindly visit:

-

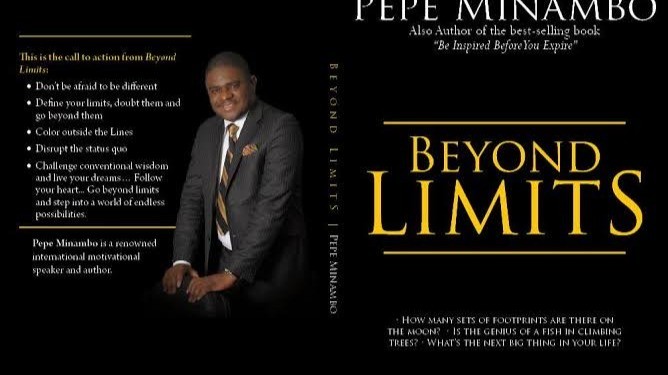

Edition 28: INSIGHTS FROM BEYOND LIMITS BY PEPE MINAMBO

Written by Adv. Brownie Ebal

Beyond Limits invites you to embark on a transformative journey that challenges you to embrace your uniqueness and redefine your boundaries. With a powerful call to action, this book encourages you to be unafraid of being different to color outside the lines, and to disrupt the status quo. By challenging conventional wisdom and following your heart, you will unlock a world of endless possibilities. Written by Pepe Minambo, a renowned Human Resource Consultant and motivational speaker, this book draws on his extensive experience consulting for leading regional and global brands across diverse industries. With over ten best-selling inspirational books to his name, Minambo empowers readers to envision a future unbounded by limits and filled with potential.

Pepe Minambo, also the author of the best-selling book Be Inspired Before You Expire, shares profound insights in his latest work, Beyond Limits. He poses thought-provoking questions: “How many sets of footprints are there on the moon? Is the genius of a fish in climbing trees? What is the next big thing in your life?” Minambo asserts, “The future belongs to those who create it,” emphasizing the importance of self-belief and proactive engagement in shaping one’s destiny.

As individuals age, Minambo observes, they often become acutely aware of their inadequacies. He notes, “We start to self-consciously focus on our limitations, leading to mediocre thinking patterns that prevent us from taking risks.” This mindset, he argues, transforms potential high achievers into individuals who merely survive rather than thrive.

In Beyond Limits, Minambo challenges readers to reconnect with their inherent greatness. He urges a return to the drawing board, encouraging individuals to rediscover their passion for life, dream boldly, and reject mediocrity. He emphasizes, “Many people have an idea of their purpose in life. They know where they belong, but limits often stand between them and their destiny.”

One critical question Minambo raises in his discussions is, “How do you know you are serving your purpose?” According to him, the answer lies in the world’s response to an individual: “If you are living in your purpose, the world celebrates you; if not, it merely tolerates you.”

To assist in the discovery of one’s purpose, Minambo outlines exercises conducted in his academy, where he teaches public and motivational speaking. He instructs students to create a “purpose statement” encompassing their passions, aspirations, and plans for achievement. He highlights two exercises that facilitate this process:

1.Personal Timeline: Students create a timeline from birth to their current age, gaining insights into their behaviors and passions.

2.External Feedback: Students seek input from three close individuals about their perceived purpose. Minambo asserts, “You can never see the picture when you’re in the frame,” emphasizing the value of external perspectives.

He stresses the importance of curiosity, stating, “The future belongs to the curious, those who relentlessly ask questions.” A quote he shares reinforces this: “He who asks a question remains stupid for only five minutes, but he who does not ask remains stupid for a lifetime.”

Minambo proposes five questions for self-discovery

1.What makes me sing? (Your joy)

2.What makes me cry? (Your passion)

3.What makes me dream? (Your imagination)

4.What makes me excel? (Your strength)

5.What makes me different? (Your uniqueness)

“To live a dynamic life,” he notes, “nothing becomes dynamic until it becomes specific.” He urges individuals to focus on their primary passions, using the metaphor of “Coke” to symbolize core pursuits that should take precedence over distractions.

Minambo cautions against procrastination and indecision, quoting an African proverb: “Indecision is like a stepchild. If he does not wash his hands, he is called dirty; if he does, he is wasting water.” He implores readers to take action without delay, affirming, “Whatever needs to be done, do it now.”

He cites Goethe’s wisdom: “Until one is committed, there is hesitancy,” emphasizing that commitment catalyzes progress. He urges readers to “decide today to move beyond fear and uncertainty” and to reject procrastination.

Addressing how past experiences can shape identity, Minambo notes that some individuals let negative events dictate their perceptions. “A cat that once sat on a hot stove will never sit on a stove again, even if it is cold,” he explains, illustrating how past traumas can hinder present experiences. He advocates for learning from the past while focusing on the present and future.

In reflecting on his journey, Minambo shares, “I have knocked, I have sought, and I have asked, and life has responded in kind.” He emphasizes that life offers opportunities to those who persist despite obstacles and fears.

He concludes by stating that limitations are illusions created by the mind. “At any moment, we can choose to see beyond these boundaries,” he asserts. Success, according to Minambo, is not defined by the absence of challenges but by the courage to confront them. He encourages embracing challenges as catalysts for growth and transformation.

In the end, Minambo reminds us that life is about choices: “the choice to dream, the choice to act, and the choice to persevere.” His narrative serves as an inspiring testament to resilience, reinforcing that success is a journey of persistence and vision.

Minambo emphasizes that personal growth requires more than just ambition; it demands resilience and a proactive approach to overcoming obstacles. “Success is not merely a destination but a continuous journey,” he asserts. This perspective encourages individuals to see their setbacks not as failures, but as essential components of their development.

He also speaks to the importance of community and collaboration in the pursuit of goals. “We are stronger together,” he states, highlighting how sharing experiences and resources can amplify success. By fostering connections and leveraging the goodwill of others, individuals can unlock new opportunities and pathways to achievement. “Never underestimate the power of collective effort,” Minambo advises, as it can lead to innovations and breakthroughs that might be unattainable alone.

Moreover, he underscores the significance of self-belief. “To transform your reality, you must first believe that transformation is possible,” he urges. This self-affirmation acts as a catalyst for change, enabling individuals to challenge their limits and strive for greatness. By cultivating a mindset that embraces possibility and growth, they can begin to break down the barriers that have held them back.

As Minambo reflects on his journey and the lessons he has learned, he shares that gratitude plays a crucial role in maintaining motivation and perspective. “Being grateful shifts your focus from what you lack to what you have, and that is a powerful motivator,” he explains. This practice not only enhances personal well-being but also fosters a positive environment that can inspire those around you.

In conclusion, Minambo’s insights serve as a compelling reminder that life is a canvas waiting to be painted. With courage, collaboration, and a commitment to continuous growth, individuals have the potential to create their own masterpieces. “The universe is full of possibilities,” he affirms, encouraging everyone to embrace their unique journey and pursue their dreams with unwavering determination.

As you embark on this new chapter, remember that the future is a reflection of the choices you make today. Embrace your journey, inspire others, and always strive to go beyond limits. The world is waiting for you to create your legacy.

For feedback, inquiries or to connect with the author, feel free to reach out via email at pepe@motivatorafrica.net

-

Edition 27: CAPITAL MARKETS ROUND TABLE

The final day of World Investors Week 2024 in Uganda culminated with profound insights under this year’s theme, “Tech-Enabled Financial Inclusion: Bringing Sustainable Finance and Investment Opportunities to Everyone.” Focused on expanding access to sustainable investments, the discussions highlighted how technology can bridge financial gaps, ensuring more Ugandans participate in capital markets and benefit from a more inclusive economy. With key speakers from government, financial institutions, and technology providers, the day offered a roadmap for sustainable growth, financial literacy, and investment opportunities.

Government’s Role in Sustainable Growth and Financial Inclusion

Uganda’s Minister of Finance outlined the government’s commitment to sustainable growth through the Medium-Term Budget Framework (MBF-4), emphasizing productivity, value addition, human capital development, private sector support, infrastructure, and governance. These pillars, the minister noted, will create a conducive environment for sustainable finance and investment.

Insights from Listed Companies: Growth, Inclusion, and Scrutiny

The first panel brought in representatives from listed companies, who discussed the transformative benefits of being publicly listed on the Uganda Securities Exchange (USE). Key advantages included increased visibility, strengthened governance through attracting independent directors, and internal capital growth. Panelists highlighted the importance of maintaining transparent records to leverage these benefits fully.

One company, DFCU, illustrated how its listing has enhanced financial inclusion by enabling partnerships that support financial literacy programs, mobile banking applications, and broader access to services. The scrutiny from the Capital Markets Authority (CMA) and USE, while rigorous, has fostered a culture of growth and accountability, allowing companies to prioritize sustainability and investor returns.

Sponsor Reflections: Educating and Empowering Investors

Media partners SMART 24 and New Vision emphasized the critical role of investor education. SMART 24 stressed the importance of enabling Uganda’s private sector to drive GDP growth. New Vision echoed this by committing to responsible journalism through various formats—articles, podcasts, and talk shows-that aim to empower investors and foster a more informed public.

The Deposit Protection Fund (DPF) also played a significant role in educating the audience on financial security. It urged Ugandans to update their account details regularly to ensure they remain protected under the fund’s guarantee in case of bank failures.

Expanding Capital Markets through Knowledge and Accessibility

Panelists underscored that financial inclusion in capital markets begins with knowledge. Limited financial literacy and income levels, influenced by skills shortages, remain significant barriers. Xeno, a local asset management firm, is addressing this challenge by offering a user-friendly platform that allows individuals to save and invest based on future financial goals. Serving 50% of Uganda’s population, Xeno exemplifies the power of accessible technology to boost financial inclusion.

For investors, asset management offers numerous benefits, including diversified portfolios, improved cash flow management, and financial planning advice. While some fear that NSSF’s increasing role in the market could overshadow other unit trusts, panelists clarified that NSSF’s primary focus remains on retirement planning, leaving room for other funds to address diverse financial goals.

AI and Technology as Catalysts for Financial Inclusion

Nesta Paul Katende presented an insightful session on AI’s role in promoting financial inclusion and sustainable finance in emerging markets like Uganda. AI’s capacity to enhance access to credit, personalize financial products, and automate customer service can help overcome inclusion barriers. Beyond efficiency, AI in financial literacy and investor protection enables personalized learning and robust fraud detection systems.

In capital markets, integrating AI tools allows financial intermediaries to broaden investment access, reach underserved communities, and promote inclusive and sustainable finance. This AI-driven transformation points to a future where technology not only optimizes finance but also fosters financial empowerment.

The Importance of Sustainable Finance and Regulatory Support

In a session on sustainable finance, experts discussed three key pillars:

1. Environment – Managing natural resources sustainably to support business while conserving the environment.

2. Social Impact – Ensuring business practices benefit society, promote workplace inclusivity, and enhance occupational safety.

3. Governance – Promoting sustainable decision-making at the board level, with green bonds highlighted as a financing example.

Stanbic Bank, represented by Mr. Ssemakulu, shared its commitment to financial sustainability through initiatives like training over 15,000 women. Regulators, such as the CMA, are shaping the sustainability agenda by incorporating Environmental, Social, and Governance (ESG) principles into their frameworks, aligning with Uganda’s National Development Plan and international goals.

From a regulatory perspective, frameworks are being developed to protect investors, enforce compliance, and promote sustainable investments. Investors, in turn, can contribute to sustainability by advocating for policies and supporting projects that align with ESG principles.

Government and CMA’s Role in Advancing Financial Inclusion

The closing panel explored the role of government in promoting financial inclusion. CMA has prioritized public education as part of its program, with World Investors Week being one avenue to increase financial literacy. NSSF also emphasized financial inclusion as a core part of its social security mandate, encompassing contributions, investments, and benefits payouts.

Efforts to reduce barriers to internet access were discussed, with suggestions including competition and reduced taxation to make internet more affordable. The panel also reinforced the importance of cultivating a saving culture, regardless of income levels, as a foundation for future investment.

The discussions at World Investors Week 2024 underscored a collective vision for a more inclusive and sustainable financial future in Uganda. By embracing technology and building foundational knowledge, Uganda can unlock greater financial participation and investment opportunities for all citizens. The week highlighted that while capital is crucial, informed decision-making and a robust understanding of sustainable finance are essential for long-term growth. With technology as a driving force, Uganda is well-positioned to foster a financial landscape that empowers its people and meets global standards for inclusivity and sustainability.

For more information on these investment opportunities, kindly visit these websites:

-

Article 26: Women In Investment Breakfast 2024

Written by Adv. Brownie Ebal

I attended the Women in Investment Breakfast 2024 in the capacity of Partner at Nuwajuna Associated Advocates (NAA), where I serve as Secretary of Powerhouse Investment Club and as Legal Affairs for Water Family Investment Club. Both clubs are startups with a combined portfolio of over 200 million shillings. The breakfast, held on October 23rd at Kampala’s Protea Hotel, was a highlight of the World Investor Week (WIW) 2024, which focused on the theme “Tech-Enabled Financial Inclusion: Bringing Sustainable Finance and Investment Opportunities to Everyone.”

The event underscored the critical role of technology in expanding financial inclusion, particularly for women, and was organized by the Capital Markets Authority (CMA) and Uganda Securities Exchange (USE) as part of broader efforts to promote financial literacy. Ms. Jacintah Akino, Manager of Legal and Compliance at USE, opened the event with welcome remarks, emphasizing the importance of empowering women through financial education and inclusion.

Ms. Renita Nabisubi, Non-Executive Director at USE, delivered an insightful presentation on technological advancements at the Uganda Securities Exchange, explaining how technology can offer women more opportunities to invest their savings in instruments that generate returns. She expressed hope that the week would provide women with practical insights into raising capital for their businesses, encouraging participants to ask critical questions. She concluded by stating, “Together, we can build stable financial systems where everyone thrives.”

The keynote speech by Ms. Josephine Okui Ossiya, CEO of CMA, centered around the event’s theme, which she described as speaking to the heart of finance. She emphasized the importance of leveraging technology to ensure financial inclusion and pointed out that financial inclusion is more than just a goal; it is a catalyst for social and economic transformation. For women in particular, this intersection of potential and opportunity can lead to profound impacts. She quoted, “Educate a woman to educate the nation,” underscoring the far-reaching effects of women’s empowerment in finance. She concluded with a call to action, urging women to reflect on how they can deliberately create the impact they wish to see as they invest in different spaces.

The first panel discussion focused on empowering women investors, exploring strategies for investment opportunities, raising capital, and overcoming challenges. Some of the challenges highlighted included low income, which affects women’s ability to invest, the burden of black tax, limited learning opportunities for women to qualify for leadership roles, procrastination, and the tendency to be risk averse.

The panelists shared practical strategies for raising capital, emphasizing the importance of formalizing businesses, structuring them in a way that allows operations to continue even in the absence of the founder, and positioning businesses effectively by being able to confidently speak about them. Above all, the panel stressed the need for women to be intentional in their business and investment endeavors.

In terms of technology, the discussion underscored how advancements have made it easier for women to engage in financial transactions even without cash on hand, with mobile money serving as a prime example of how technology is transforming access to finance and enabling more women to participate in the economy.

Another key session explored investment success stories, featuring women at various stages of life who have successfully navigated the capital markets. Moderated by Lyn Tukei, the panel included representatives from institutions such as Britam, SBG, UAP, and Sanlam. These women shared personal stories and experiences, offering practical insights on how technology has played a pivotal role in shaping their investment journeys. They highlighted how technology has transformed the way they approach investing, making it more accessible and efficient.

The panelists also emphasized the importance of cultivating a habit of saving as a foundation for investment. They encouraged women to start small, be consistent, and embrace the power of compounding. They highlighted the value of seeking expert advice to gather all necessary information, using technology to conduct thorough research, and avoiding becoming an enemy of progress by sharing valuable information with others. Additionally, they stressed the importance of focusing on long-term investments for sustainable growth.

The event concluded with remarks from Ms. Irene Birungi, CEO of the Presidential CEO Forum, who reflected on the discussions of the day and called for continued efforts to promote tech- enabled financial inclusion for all, particularly women. The breakfast provided an invaluable platform for networking, knowledge sharing, and fostering connections among women investors, professionals, and regulators, further strengthening the collective push towards inclusive financial markets.

In conclusion, the discussions highlighted the critical role of women in the investment landscape, emphasizing the importance of combining legal expertise with business acumen. As professionals in the legal field, we have a unique opportunity to empower ourselves and others to navigate investment opportunities effectively. By fostering financial literacy and collaboration, we can drive meaningful change and create sustainable ventures that positively impact us and our communities.

About Me

I love reading, writing, attending events, learning, leadership and meeting new people.

I hold a Masters Degree in International Law and I am passionate about life.

If you are interested in learning more about self discovery and becoming the best version of yourself.

Follow Me On

Subscribe To My Newsletter

Subscribe for new stories and exclusive content.