Hello, I am Advocate Brownie Ebal

I am a legal Practitioner, Venture Capitalist and Philanthropist.

Welcome to my site.

I love life, travelling, food, beauty, the law, leadership and meeting people from diverse backgrounds. I hope to inspire each one of you with my various articles as I share from my experiences around our beautiful world.

I live in Kampala, Uganda.

-

Article 73: Focus Is a Decision: Three Words and Five Non- Negotiables for a Successful Year.

In one of her recent episodes, 3 Words to Get Focused this Year | Plus the 5 Non-Negotiables that Set You Up for Success, Terri Savelle Foy offers a timely reminder that focus is not something we wait to feel, it is something we choose. In a world full of noise, competing priorities, and constant demands on our attention, focus has become one of the most valuable personal assets we can cultivate. What makes Terri’s message resonate is its simplicity: lasting focus doesn’t come from doing more, but from deciding better.

At the centre of her message are three powerful words: “I will do.” These words draw a clear line between intention and action. They move us away from wishful thinking and into ownership. Not “I hope,” not “I’ll try,” but “I will.” When we decide in advance what we will do, distractions lose their authority. Focus sharpens because we are no longer negotiating with ourselves daily, we are acting from commitment, not convenience.

But clarity alone is not enough. Focus must be protected, and that protection comes from structure. Terri outlines five non-negotiables that quietly but consistently position people for success not through pressure, but through discipline and alignment.

- A Consistent Morning Routine: How you start your day determines how you show up for it. A focused life begins with intentional mornings, time to reset your mind, review your goals, and ground yourself before the world makes demands on you.

- Written Goals You Actually Review: Goals that live only in your head compete with fear, distractions, and excuses. Written goals bring direction. Reviewed goals bring focus. If you don’t look at your goals regularly, your daily actions will drift.

- Guarded Time: Focus requires boundaries. Successful people don’t wait for time, they protect it. Whether it is time for personal growth, planning, health, or faith, guarded time turns priorities into reality.

- Feeding Your Mind Daily: What you consume consistently shapes what you believe. Books, podcasts, affirmations, and teaching that stretch your thinking are not optional—they are maintenance for focus and confidence.

- Consistency Over Intensity: Focus is not built by occasional bursts of effort. It is built by showing up repeatedly, even when the effort feels small. Small, disciplined actions compound into massive results over time.

What ties Terri Savelle Foy’s message together is the power of decision. Focus is not a personality trait or a lucky break, it is a choice reinforced daily by habits and boundaries. When your words are intentional, your goals are visible, your time is protected, and your mind is nourished, focus stops being something you chase. It becomes something you live.

This year does not require more pressure or perfection. It requires clearer decisions. Sometimes, all it takes to reset your direction are three simple words, “I will do” and the courage to make your non-negotiables truly non-negotiable.

-

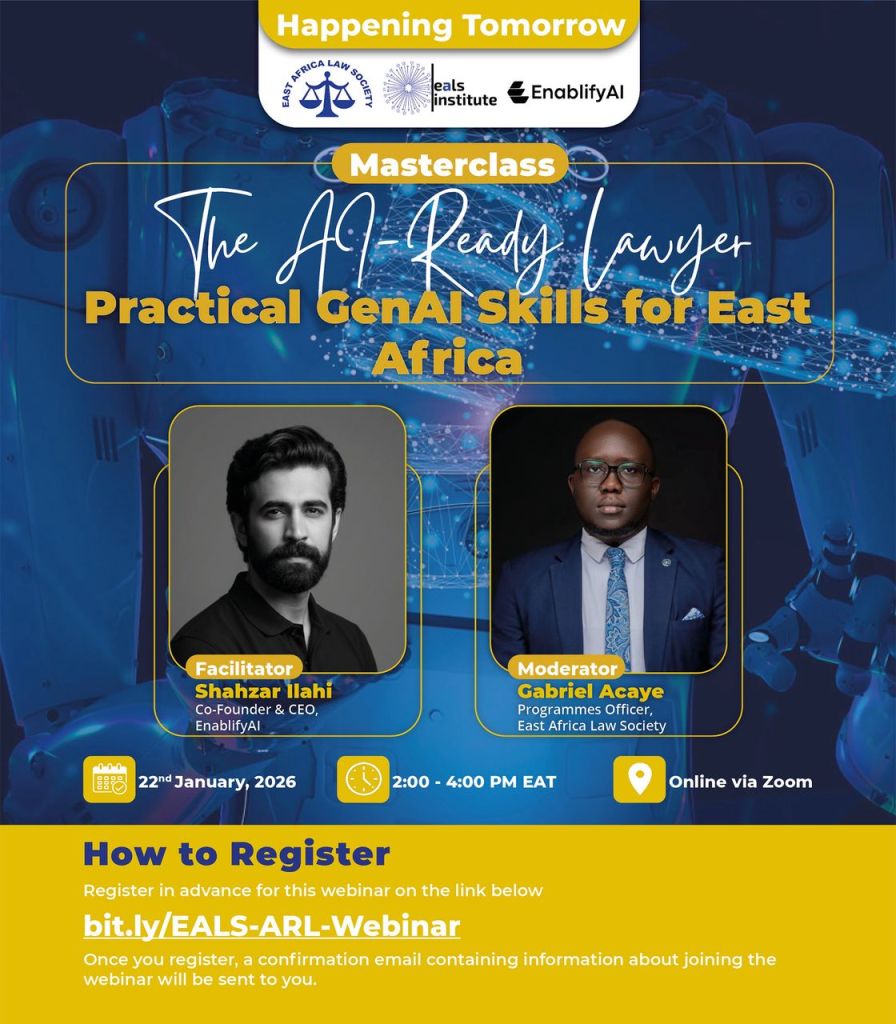

Article 72: The AI Ready Lawyer: Practical GenAI skills for East Africa.

On 22nd January, 2026, the East Africa Law Society convened its first webinar of the year under the theme “The AI-Ready Lawyer: Practical GenAI Skills for East Africa,” bringing together legal professionals from across the region for a candid and hands-on conversation about the future of legal practice. The session was moderated by Gabriel Acaye, Programmes Officer at the East Africa Law Society, who welcomed participants on behalf of the Society’s leadership and set a clear tone for the discussion. He noted that artificial intelligence was no longer a theoretical or emerging concept for the legal profession, but a present and rapidly evolving reality already reshaping how law is practiced. The purpose of the session, he explained, was not to dwell on trends or hype, but to focus on how lawyers were responding in real time, and whether they were doing so competently, safely, and ethically. He emphasized that the master class was designed to equip lawyers with practical, immediately usable skills, positioning them to become AI-ready rather than AI-dependent, technologically capable while still grounded in professional standards and judgment. He also noted that the webinar served as a precursor to a physical master class scheduled to take place in Nairobi in March 2026, organized in partnership with Enablify.

The facilitator, Shahzar Ilahi, Co-Founder of Enablify, began by situating the discussion within a global context, observing that East Africa had shown remarkable openness to technological adoption, including early uptake of generative AI tools. He cautioned that the legal profession was already experiencing disruption at a pace rarely seen in previous technological shifts, describing artificial intelligence not simply as a new tool, but as a behavioural and structural change in how professional work is done. Drawing on insights from Professor Richard Susskind, adviser to the UK Supreme Court on AI and law, he underscored that markets tend to show little loyalty to traditional methods if faster, cheaper, and better alternatives exist. This tension, he noted, left lawyers both inspired by new possibilities and unsettled by the speed of change.

Shahzar illustrated this disruption through concrete examples, including his own experience of public resistance when he predicted that lawyers who failed to adapt to AI would become irrelevant within a decade — a position that was later echoed in a Supreme Court of Pakistan judgment. He pointed to developments in the Middle East, where AI-driven court systems were being introduced to process disputes digitally, generate preliminary judgments, assess probabilities of success, and divert matters to mediation or settlement where appropriate. While acknowledging the debates surrounding such systems, he emphasized that their deployment signaled an irreversible shift. He supported this with data showing dramatic increases in daily and hourly AI use by lawyers within a short time span, alongside a steep decline in entry-level legal roles globally. The issue, he stressed, was not the replacement of lawyers per se, but the replacement of lawyers who lacked the skills to work effectively with artificial intelligence.

To ground the discussion, Shahzar walked participants through what artificial intelligence actually is and how it works, tracing its origins back to the 1940s and the work of Alan Turing. He explained that tools like ChatGPT were applications of a much older technology, and reminded participants that they had long been interacting with and training AI systems through everyday digital activities such as image verification, predictive text, and facial recognition. He drew parallels between human intelligence and machine learning, explaining how both rely on data acquisition, pattern recognition, storage, and output. The key distinction, he noted, lay in scale: machines could ingest and process volumes of information far beyond human capacity, at extraordinary speed.

Building on this foundation, Shahzar introduced generative artificial intelligence as a category focused on producing outputs — text, images, video, analysis — from user inputs. Through live demonstrations, he showed how widely accessible tools could generate professional visuals, videos, websites, legal summaries, timelines, and learning materials in minutes, tasks that would traditionally take hours or days. He emphasized that the real value for lawyers lay not in replacing legal reasoning, but in automating routine, time-consuming tasks, allowing practitioners to focus on strategy, judgment, and client engagement. He also cautioned participants about risks such as hallucinations, confidentiality breaches, and over-reliance, stressing the importance of controlled use, proper prompting, and ethical safeguards.

Throughout the session, Shahzar returned to a central message: artificial intelligence was already embedded in the legal ecosystem, and the responsibility now lay with lawyers to understand it well enough to use it responsibly. The master class, he concluded, was not about turning lawyers into technologists, but about ensuring they remained relevant, effective, and future-facing in a profession undergoing profound transformation.

For more, please watch full video: https://www.youtube.com/live/NnUtQHZZr60

-

Article 71: From Compliance to Accountability: Corporate Governance in a Technology-Driven Era.

On 29th January 2026, the East Africa Law Society convened a regional webinar bringing together legal practitioners, in-house counsel, board advisers, and governance professionals to examine the evolving demands of corporate leadership. Held under the theme Corporate Governance in the Modern Era: AI Accountability, ESG Enforcement & Board Risk Management, the session explored how technology, sustainability expectations, and risk oversight are reshaping decision-making across African boardrooms.

The discussion was framed around a shared recognition that corporate governance is no longer defined solely by compliance structures or periodic board reporting. Artificial intelligence is already influencing strategic, operational, and human-resource decisions; ESG considerations are rapidly moving from voluntary commitments to measurable obligations; and boards are increasingly expected to anticipate risks that are dynamic, interconnected, and often unfamiliar. The webinar therefore sought to move beyond surface-level conversations and engage with how governance must adapt in practice.

The conversation on artificial intelligence was anchored by Florence Anyango, an advocate of the High Court of Kenya and a research fellow at Strathmore University’s Centre for Intellectual Property and Information Technology. She observed that AI systems are already embedded across sectors such as finance, recruitment, supply chains, and strategic planning, often without clear visibility at board level. By distinguishing between AI-supported, AI-triggered, and fully automated decisions, Florence illustrated how technology now shapes outcomes affecting employees, consumers, and markets. She cautioned that these developments introduce significant legal, ethical, and reputational risks, particularly where decisions are opaque, difficult to contest, or directly affect individuals. While many African jurisdictions do not yet have AI-specific legislation, she noted that existing legal frameworks on data protection, non-discrimination, labour relations, consumer protection, and human rights already impose real accountability. Drawing from regional and global instruments, including UNESCO’s ethical principles, the OECD AI guidelines, and the African Union’s AI Continental Strategy, she underscored the importance of transparency, human oversight, and a people-centred approach to AI deployment.

Building on this foundation, Emily Disa, a partner at Ortus Advocates and a seasoned finance, risk, and governance professional, shifted the focus to board-level risk management. She situated AI and ESG within a broader risk environment defined by volatility, cyber threats, climate-related disruptions, and rapid digital transformation. Emily noted that boards are increasingly expected to oversee risks they may not fully understand, yet ignorance offers no protection from liability or reputational damage. She highlighted cyber security and data governance as foundational risks, given the growing value of data and the rise of AI-enabled attacks, and warned that failures in these areas can escalate quickly into regulatory and public-trust crises. Her remarks emphasised the need for boards to integrate emerging risks into existing governance structures, strengthen oversight through dedicated committees, and invest in continuous education and scenario planning.

The discussion on sustainability and accountability was further enriched by Felista Kim Manuka, General Counsel and Company Secretary at Bank of Kigali PLC, who examined ESG from both a governance and business perspective. She explained that ESG has moved decisively from being a reputational or voluntary exercise to a strategic and regulatory priority. Felista highlighted the tangible benefits of embedding ESG into corporate strategy, including operational efficiency, enhanced investor confidence, improved access to capital, and stronger employee engagement. She also underscored the critical role of boards in setting the tone on ESG, overseeing disclosures, and guarding against greenwashing by ensuring that sustainability claims are supported by credible data and governance processes. Reference was made to emerging regional practices and global standards such as the International Sustainability Standards Board and climate-related financial disclosure frameworks, which are increasingly shaping expectations across African markets.

Offering a practitioner’s perspective, Alan Rakoko, Head of Legal Services at Umeme Limited, reflected on the growing exposure of boards, senior management, and legal advisers to personal and institutional liability. He noted that regulatory trends across the region are steadily expanding accountability beyond the corporate entity to individual decision-makers, particularly in regulated sectors. Alan emphasised that ESG reporting, AI governance, and integrated reporting are no longer optional add-ons but core components of corporate risk management. He drew attention to evolving governance frameworks, including the latest developments in the King V Report, which reinforce the need for ethical leadership, stakeholder inclusivity, digital responsibility, and proactive oversight of technology-driven risks.

Throughout the webinar, a consistent theme emerged: governance in the modern era requires anticipation rather than reaction. Whether engaging with artificial intelligence, strengthening ESG oversight, or managing board-level risk, organisations must move beyond policy adoption to meaningful implementation. The session concluded with a call for governance professionals to translate global principles into local practice, ensuring that emerging technologies and sustainability commitments are aligned with African realities, institutional capacity, and public trust.

For more, please watch full video: https://www.youtube.com/live/Ppbx3tQWsf8

-

Article 70: The 5 Jars Principle: A Faith-Centred Approach to Financial Stewardship

Money is one of the earliest tools of independence most people encounter, yet it is rarely accompanied by wisdom on how to manage it well. For many young adults, income arrives before instruction, and financial decisions are made through trial, pressure, or imitation rather than intention. The result is often confusion, anxiety, debt, and a fractured relationship with money. The 5 Jars Principle offers a simple yet profound framework that restores clarity, discipline, and purpose to personal finance, while anchoring financial decisions in faith and values.

At its heart, the 5 Jars Principle is not merely a budgeting method; it is a stewardship mindset. It teaches that money is not owned absolutely, but entrusted. This perspective shifts the focus from consumption to responsibility, from impulse to planning, and from scarcity to purpose. By assigning every portion of income a role before spending begins, individuals learn to lead their money rather than react to it.

The principle is often taught using physical jars, especially for children and young adults, because it transforms an abstract concept into a visible, practical habit. Each jar represents a clear financial priority. As income is received, it is intentionally divided, reinforcing the idea that wise financial living is proactive, not accidental. Over time, this practice shapes character as much as it shapes bank balances.

When applied consistently, the 5 Jars Principle nurtures financial maturity by integrating faith, generosity, growth, preparation, and enjoyment into one coherent system. It recognises that financial health is not achieved by focusing on one area alone, but by maintaining balance across all aspects of life.

The five jars are introduced as follows.

The first jar is the Tithe Jar, which represents putting God first. This jar is set aside before anything else, affirming that God is the source of all provision. By honouring God with the first portion of income, individuals cultivate gratitude, humility, and trust. Scripture reminds us, “Honor the LORD with your wealth, with the firstfruits of all your crops” (Proverbs 3:9), and further affirms that “a tithe of everything… belongs to the LORD” (Leviticus 27:30). Tithing is therefore not framed as loss, but as alignment — a declaration that faith governs financial decisions. This practice trains the heart to depend on God rather than money and establishes spiritual order in personal finances.

The second jar is the Blessing Jar, dedicated to generosity towards others. This jar reflects the understanding that money is also a tool for compassion and community. Through intentional giving, individuals learn to look beyond themselves and recognise the needs around them. The Bible teaches, “Give, and it will be given to you” (Luke 6:38), and also assures us that “a generous person will prosper; whoever refreshes others will be refreshed” (Proverbs 11:25). Generosity builds empathy, strengthens relationships, and reminds us that wealth finds its highest purpose when it uplifts others. This jar guards against selfishness and nurtures a lifestyle of kindness and service.

The third jar is the Investing Jar, which focuses on long-term growth. Here, individuals are encouraged to think beyond immediate needs and pleasures, and to plan for the future with wisdom and diligence. Scripture affirms this principle clearly: “The plans of the diligent lead surely to abundance” (Proverbs 21:5), and “whoever gathers money little by little makes it grow” (Proverbs 13:11). Investing teaches patience, discipline, and responsibility. Whether through education, entrepreneurship, or structured investments, this jar equips individuals to grow resources steadily and sustainably over time.

The fourth jar is the Savings Jar, which prepares individuals for life’s uncertainties and opportunities. Saving is an expression of wisdom and foresight. The Bible uses the example of the ant to illustrate this truth: “Go to the ant, you sluggard; consider its ways and be wise” (Proverbs 6:6). It further states that “the wise store up choice food and olive oil” (Proverbs 21:20). By setting aside funds for emergencies or future needs, individuals avoid panic-driven decisions and unnecessary debt. This jar fosters peace of mind and reinforces the value of preparation.

The fifth and final jar is the Spending Jar. After honouring God, giving generously, investing wisely, and saving intentionally, individuals are free to enjoy what remains responsibly. Scripture affirms that enjoyment, when rightly ordered, is part of God’s design: “There is nothing better for people than to enjoy their work… this is a gift from God” (Ecclesiastes 3:13). This jar acknowledges that balance matters — life is meant to be lived fully, not anxiously. By placing spending last, the system ensures that enjoyment does not undermine stewardship, but flows from it.

What makes the 5 Jars Principle particularly effective is its simplicity. It is easy to understand, easy to teach, and easy to adapt to different income levels. More importantly, it works because it aligns behaviour with values. It removes ambiguity from financial decisions and replaces it with clarity. Every coin has a purpose, and every choice becomes intentional.

For young adults especially, this framework lays a strong foundation. It encourages living within one’s means, avoiding unnecessary debt, building financial resilience, and developing a healthy relationship with money early in life. Over time, the jars may change in size as income grows, but the principles remain constant.

Ultimately, the 5 Jars Principle reminds us that financial wisdom is not separate from spiritual life. How we manage money reflects what we value, what we trust, and what we prioritise. When finances are stewarded with intention and faith, they become a source of peace rather than pressure, and a means of purpose rather than anxiety.

Wise stewardship is not about how much we earn, but how faithfully we manage what we receive.

For further reading and additional perspectives on the 5 Jars Principle:

About Me

I love reading, writing, attending events, learning, leadership and meeting new people.

I hold a Masters Degree in International Law and I am passionate about life.

If you are interested in learning more about self discovery and becoming the best version of yourself.

Follow Me On

Subscribe To My Newsletter

Subscribe for new stories and exclusive content.