Hello, I am Advocate Brownie Ebal

I am a legal Practitioner, Venture Capitalist and Philanthropist.

Welcome to my site.

I love life, travelling, food, beauty, the law, leadership and meeting people from diverse backgrounds. I hope to inspire each one of you with my various articles as I share from my experiences around our beautiful world.

I live in Kampala, Uganda.

-

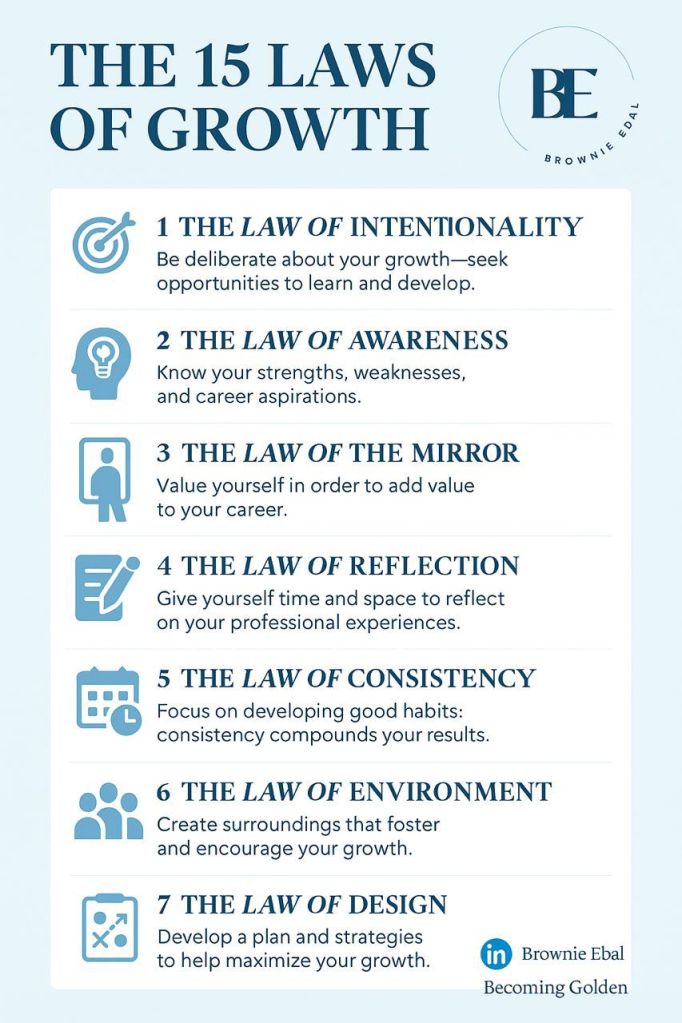

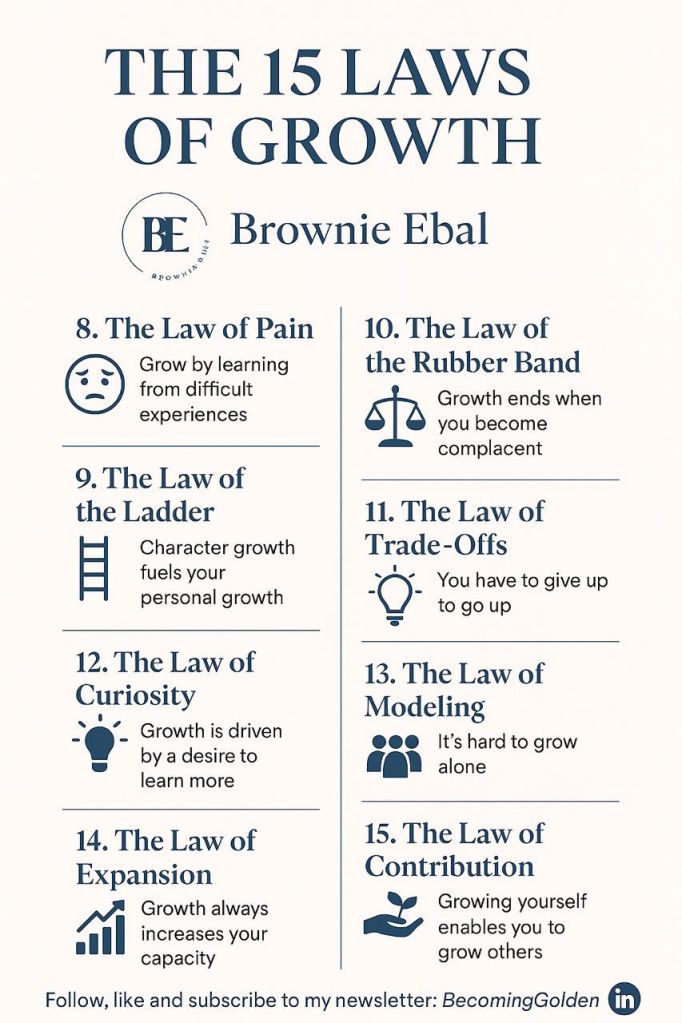

Article 55: Key practical take aways from the 15 Invaluable Laws of Growth.

Written by Adv. Brownie Ebal.

Personal growth is not accidental—it is intentional. Over the past few years, The 15 Invaluable Laws of Growth by John C. Maxwell has become more than just a book to me. It is a framework I keep returning to as I navigate my journey in the legal profession. Here are my key takeaways from the book, and how each one has shaped my mindset, strategy, and growth as a legal professional.

1. The Law of Intentionality – Growth Doesn’t Just Happen

In the legal field, advancement is never accidental. I’ve learned to be deliberate about my growth—seeking mentorship, training, and complex matters that stretch my abilities.

2. The Law of Awareness – You Must Know Yourself to Grow Yourself

Understanding my strengths—be it advocacy, analysis, or negotiation—and being honest about my gaps allows me to position myself strategically in any organization.

3. The Law of the Mirror – You Must See Value in Yourself to Add Value to Yourself

Confidence is everything, especially in high-stakes environments. I have learned to acknowledge my value so I can own the room, add meaningful input, and lead with presence.

4. The Law of Reflection – Learning to Pause Allows Growth to Catch Up with You

I now schedule time to reflect on cases, decisions, and even missteps. That reflection sharpens my judgment and builds the kind of maturity needed at higher levels.

5. The Law of Consistency – Motivation Gets You Going, Discipline Keeps You Growing

Motivation fluctuates. But discipline—showing up, delivering excellence, and staying committed—is what has helped me earn trust from partners and senior leadership.

6. The Law of Environment – Growth Thrives in Conducive Surroundings

I seek rooms where people challenge me, not just cheer for me. Growth has accelerated when I am around bold thinkers and seasoned professionals who push me beyond my comfort zone.

7. The Law of Design – To Maximize Growth, Develop Strategies

I approach my career like I would any complex legal issue—with a well-thought-out strategy. Goals, timelines, and mentorship structures keep me aligned and progressing.

8. The Law of Pain – Good Management of Bad Experiences Leads to Growth

Tough clients. Missed deadlines. Performance feedback. I have learned to turn every hard moment into a stepping stone—not a stumbling block.

9. The Law of the Ladder – Character Growth Determines the Height of Your Personal Growth

In law, your integrity is everything. Character determines who gets invited into trusted, strategic conversations—and who gets quietly sidelined.

10. The Law of the Rubber Band – Growth Stops When You Lose the Tension Between Where You Are and Where You Could Be

I have become addicted to that stretch between comfort and challenge. Staying stretched is how I have made leaps others hesitated to take.

11. The Law of Trade-Offs – You Have to Give Up to Grow Up

I have had to say no to short-term comforts—certain social events, easier roles, even some friendships—to say yes to long-term growth and leadership.

12. The Law of Curiosity – Growth Is Stimulated by Asking Why

Asking “why” has helped me challenge stale practices and bring fresh insight into the legal teams I work with. Curiosity is not a weakness—it is a career advantage.

13. The Law of Modeling – It is Hard to Improve When You Have No One but Yourself to Follow.

Watching and learning from women and men I admire has been instrumental. I do not just follow their steps—I study their mindset, strategy, and presence.

14. The Law of Expansion – Growth Always Increases Your Capacity

With each new challenge I take on, I realize: I can handle more. Growth has expanded my professional range, and now I’m ready for greater leadership responsibilities.

15. The Law of Contribution – Growing Yourself Enables You to Grow Others

The real joy comes when I help officers, junior associates, interns, or colleagues find their own stride. Growth isn’t just personal—it becomes legacy.

Growth is not a one-time event; it is a lifelong journey. These laws continue to challenge me, stretch me, and shape the leader I am becoming. If you are looking to grow with intention, I highly recommend not just reading Maxwell’s book—but living it.

-

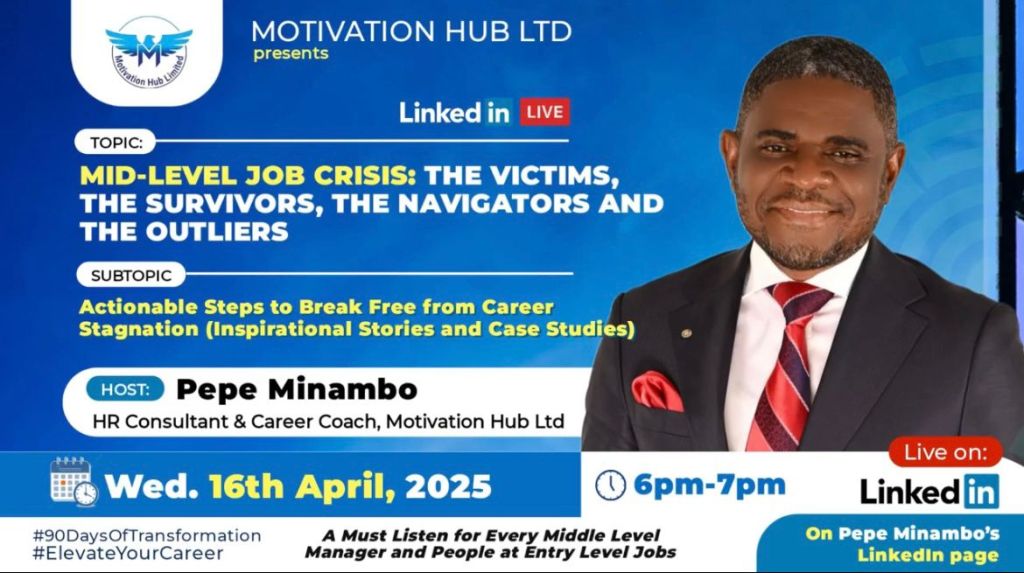

Article 54: Breaking Free from the Mid-Level Career Crisis.

Written by Adv. Brownie Ebal and Victoria Nakiyimba.

On 16th April 2025, during a compelling LinkedIn Live session, HR Consultant and Career Coach Pepe Minambo of Motivation Hub Limited shared thought-provoking insights on a topic many professionals face silently: The Mid-Level Job Crisis. Motivation Hub Limited is a leading coaching and training firm that equips professionals with tools for personal mastery, career growth, and leadership development. Their work empowers individuals to transform their mindset, communicate with impact, and lead with purpose. Learn more at: https://motivatorafrica.net/about-us

During the session, Minambo dissected the mid-career experience into four distinct categories—victims, survivors, navigators, and outliers—each representing a mindset and position that many find themselves in at different stages of their career.

Victims are those who stop growing without even realizing it. They show up, go through the motions, and wait for something external to change their path. Pepe highlighted this by recounting a story of a woman who worked for 30 years as a switchboard operator, only to receive a fridge as a retirement gift. It was a sobering reminder that neither the world nor your employer owes you anything. Growth must be self-driven. Some people, he noted, are victims not by choice, but by virtue of where they are or who they associate with.

Then there are the survivors—people who once showed immense promise, the ones who lit up interview rooms, impressed hiring panels, and started off with high expectations. But once inside the system, they faded into the background, unnoticed and unremarkable. They are not failures, but they are not fulfilled either. The promise simply fizzled out, and they end up contributing little to themselves or their organizations.

Navigators, on the other hand, do everything right on paper. They dress well, meet deadlines, are known by their bosses and clients, and stay on track. But still, they remain stuck. They seem to have everything figured out but do not progress. The issue? Attitude. It is not enough to be good; you must be intentional. You must challenge yourself beyond tasks. As Pepe emphasized, “Hire for attitude and train for skills.” Many navigators fail not because of lack of ability but because of an inability to lead their own growth.

Outliers are the rare ones who rise above. They read the company’s strategic plan. They think for themselves and for others. They are not limited by job descriptions. They make their bosses look good. They are not just workers; they are value creators. While only 15% of people think, and another 15% think they are thinking, outliers belong to neither—they are too busy acting on insight. They understand that success is not about doing more but about thinking better and leading from wherever they stand.

From these insights, the path out of stagnation becomes clear. Learn how to communicate effectively—your ideas, your intentions, and your value. Do not shy away from the politics of the office; understand the dynamics so you can move with wisdom. Make your boss look good—not in a manipulative way, but by stepping up, delivering consistently, and handling responsibilities that go beyond your role. Align your intelligence with your interests. Become someone your boss feels safe with, someone who lifts the team, not just themselves. Do not be afraid of greatness—some people were born great, yes, but others became great by daring to try. Life may twist and turn, but certain principles remain true. Follow them, and you will go further than most.

In conclusion, Pepe’s message was clear: where you start does not define where you end. Whether you are a victim, survivor, or navigator today, you can choose to become an outlier. It begins with how you think, how you act, and how you take ownership of your own growth. The mid-level crisis does not have to be your ceiling—it can be your turning point.

-

Article 53: Hard Work Doesn’t Build Wealth

Written by Adv. Brownie Ebal and Victoria Nakiyimba.

While hard work is often seen as the cornerstone of success, Scott Galloway presents a compelling case that when it comes to building true wealth, it is not enough. In a thought-provoking episode of The Diary of a CEO — a podcast hosted by entrepreneur and investor Steven Bartlett — Galloway, as the guest speaker, breaks down the habits, mindset, and long-term strategies that actually drive wealth creation.

Scott Galloway is a professor of marketing at New York University Stern School of Business, bestselling author, entrepreneur, and outspoken commentator on business and society. With a career spanning successful startups, investments, and teaching, his insights are grounded in both academic theory and real-world experience. His candid, data-driven approach has made him a respected voice on financial independence, economic inequality, and modern capitalism. Below are the key takeaways from his insights:

1. Wealth is Built Through Consistent Habits: True wealth does not come from sudden windfalls — it results from disciplined, consistent financial behavior over time. That means putting money aside from every small earning, sticking to your weekly SACCO contributions, tracking expenses, or reinvesting profits from a side hustle. These small but consistent actions create long-term security and growth.

2. Prioritize Ownership Over Income: Earning a salary is important, but building wealth requires ownership—of assets like stocks, businesses, or property. Think beyond earning — save to buy a plot of land, invest in shares through the stock exchange, unit trusts, or slowly build a business. Ownership brings passive income and long-term stability in ways a salary never can.

3. Start Financial Education Early and Talk Openly About Money: Many people avoid discussing finances, but open conversations build financial literacy. Start by budgeting together as a family, teaching children how to manage pocket money, or setting saving goals as a couple. Within your circles — at work, church, or school — create room for real conversations about money, debt, saving, and investment.

4. Define Your “Number”: Setting a clear financial goal—how much you need to feel secure or retire comfortably—helps guide spending and saving. Whether it is saving UGX 30 million to build your house, or generating UGX 100,000 a week in passive income, knowing your target makes decisions around money more intentional and grounded.

5. Diversify Investments as You Grow: As life evolves, so should your investment approach. Start with what you can manage — maybe a small retail business — and as income increases, branch out into farming, money markets, or rental units. Avoid putting all your eggs in one basket; spread risk and increase your chances of sustainable returns.

6. Take Advantage of Urban Opportunities: Cities offer exposure and growth, especially early in your career. Being in an urban center gives you access to business expos, industry events, networking spaces, and educational resources. Even just attending a free public talk or skills workshop can introduce you to your next opportunity.

7. Seek Mentorship and Build Relationships: Behind most successful careers is a network of supportive mentors. Reach out to people doing work you admire. Ask questions, be teachable, and follow up. Whether it is an older colleague, a professional group, or someone in your community — relationships shape your growth more than you realize.

8. Master the Art of Storytelling: Being able to articulate your ideas and experiences in a compelling way can influence how others perceive and engage with you. Whether you are writing a resume, presenting a business pitch, or introducing yourself in a meeting — how you tell your story matters. Learn to communicate your value clearly and confidently.

9. Start Investing Early, Even in Small Amounts: Time is your biggest ally in wealth creation. Do not wait for a lump sum. Start with what you have — UGX 5,000 a week into a SACCO, small savings in a mobile wallet, or a basic investment product. The habit matters more than the amount at the start.

10. Recognize the Role of Luck and Privilege: Success is also influenced by luck, privilege, and timing. Some people begin with more — family property, connections, or access to capital. Others do not. Acknowledge those differences, but do not be discouraged. Stay focused, stay humble, and be ready when your moment comes.

Scott Galloway’s message reframes the conversation around wealth. It is not just about hustle—it is about planning, understanding risk, owning assets, and staying disciplined. Wealth is not merely a reward for effort; it is the result of thoughtful, educated decisions made over time. And for those willing to learn, adapt, and take control of their financial path, the opportunities are real and within reach.

For more information, please click on the link to watch video: https://youtu.be/rKOx5qlLyaA

-

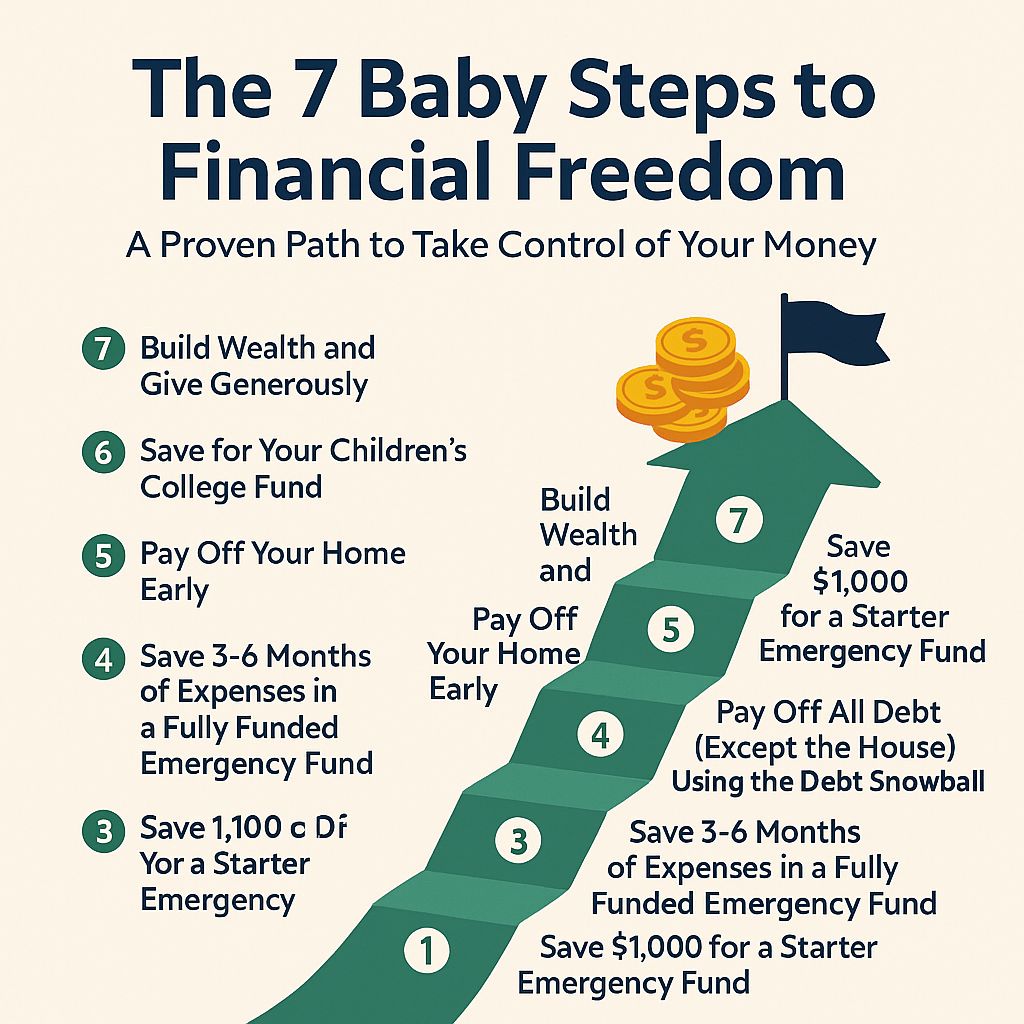

Article 52: The 7 Baby Steps to Financial Freedom: A Proven Path to Take Control of Your Money

Written by Adv. Brownie Ebal

Financial freedom is more than just having money in the bank—it is about peace of mind, flexibility, and the ability to make life decisions without being held back by debt or constant financial pressure. It means choosing how you spend your time, where you work, and how you live, with money as a tool—not a trap.

One of the clearest and most effective roadmaps to achieving financial freedom is Dave Ramsey’s 7 Baby Steps. These steps are simple, but not easy. They demand discipline, intentionality, and a mindset shift. But they have helped millions, and after watching the video, it is clear why they work: not just mathematically, but behaviorally.

Here is how they unfold:

Step 1: Save UGX 3.5 million (~$1,000) for a Starter Emergency Fund

Before focusing on paying off debt, your first goal should be setting aside a modest emergency fund. This cushion protects you from everyday surprises like a car breakdown or sudden medical expense—without turning to mobile loans or overdrafts. For liquidity and ease of access, consider keeping this emergency fund in a unit trust (unit fund) rather than a traditional bank savings account.

Unlike banks that typically offer very low interest rates on savings accounts, unit trusts invest your money in a diversified portfolio, potentially yielding better returns. They also maintain relatively quick access to your money. I personally recommend UAP Old Mutual Unit Trust—it is what I use. They issue regular statements and offer prompt withdrawals, making it an excellent option for an emergency fund. For more information, visit: https://www.uapoldmutual.co.ug

Other reputable unit trust providers in Uganda include:

- Sanlam Investments East Africa: https://invest-ug.sanlameastafrica.com

- Xeno Investment Management : https://myxeno.com

- ICEA Lion Asset Management: https://icealion.co.ug

- Britam Asset Managers: https://ug.britam.com

Kindly check them out and choose one that aligns with your investment goals and customer service expectations.

Step 2: Pay Off All Debt (Except Your Mortgage) Using the Debt Snowball Method

List all your non-mortgage debts—such as salary loans, mobile money loans (e.g., Airtel Money or MTN MoMo advances), SACCO loans, or credit card balances—from smallest to largest. Focus all your extra money on clearing the smallest debt first while making minimum payments on the rest. Each win gives you momentum and builds your confidence. In Uganda, where access to quick but costly credit is widespread, this step is crucial for breaking the debt cycle.

Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

Once you are debt-free (except your house), it is time to beef up your emergency fund. This fund should cover basic living expenses like rent, food, transport, and utilities for at least three months. If you lose your job or face a major crisis, you will have time and breathing space to recover without panic. Again, UAP Old Mutual or other low-risk money market accounts are excellent places to store this fund with access and security in mind.

Step 4: Invest 15% of Your Household Income Toward Retirement

With your safety net in place, shift your focus to long-term wealth. In Uganda, one of the best tools available is NSSF (National Social Security Fund). If you are self-employed or in the informal sector, consider making voluntary NSSF contributions—you can register easily through the NSSF Go App or visit their branches. You can also visit their website: https://www.nssfug.org for more information. In addition, explore treasury bills and bonds offered by the Bank of Uganda as stable, passive-income investment options. These instruments are secure and can yield higher returns than savings accounts over time.

Step 5: Save for Your Children’s Education

If you have children, start setting aside money for their school fees or university education. Open a dedicated education fund—many insurance companies in Uganda offer education policies with guaranteed payouts and optional life coverage. Alternatively, earmark some of your investments in treasury bonds to mature in time with your child’s academic milestones.

Step 6: Pay Off Your Home Early

Once your debts are clear, emergency fund set, and retirement and education plans are in motion, focus on eliminating your mortgage. In Uganda, this could be a loan from Housing Finance Bank or another institution. Paying off your home early saves millions in interest and gives you true financial freedom—no more rent or housing stress.

Step 7: Build Wealth and Give Generously

With no debt, a fully funded emergency reserve, ongoing investments, and a paid-off home, you are in a position to live and give with purpose. Support your church, community projects, or family in need. Generosity becomes a joy when your finances are in order—and it has a multiplying effect in society.

In conclusion, financial freedom is not just about money—it is about peace, control, and confidence. Dave Ramsey’s 7 Baby Steps offer a straightforward, actionable plan for anyone ready to take control of their finances and their future. It’s not always easy, but it is simple. And best of all—it works.

As Dave often says: “Live like no one else now, so later you can live and give like no one else.”

For more information on investments:

Joseph Areu- 0778171804

Referral: Brownie Ebal

Watch the video here to start your journey:https://youtu.be/lGHGzU3CtZg?si=RpgQIGfnCsfyVado

-

Article 51: Negotiation & Presentation Mastery for Lawyers: Win Pitches, Maximize Margins, and Draft Airtight Deals.

Written by Adv. Brownie Ebal & Victoria Nakiyimba.

On 13th May 2025, legal professionals from across the continent tuned in for a high-impact webinar titled “Negotiation & Presentation Mastery for Lawyers: Win Pitches, Maximize Margins and Draft Airtight Deals.” Organized by the East Africa Law Society (EALS), the session attracted lawyers eager to sharpen their strategic skills in client engagement, contract drafting, and high-stakes negotiation.

The East Africa Law Society, a prominent regional bar association representing over 28,000 lawyers from across the East African Community, has long been at the forefront of advancing the rule of law, cross-border legal practice, and professional development. This session was part of its broader mission to equip legal practitioners with the tools necessary to thrive in an increasingly complex and competitive market.

The panel featured four distinguished speakers: Sunday Ndamugoba, Partner at Rive & Co; Asmahaney Saad, Partner at KTA Advocates; Dr. Pie Habimana, Non-Executive Director at Bank of Kigali Plc; and Modeste Mulumba, Managing Partner at Modest Mulumba Law Firm. Together, they offered a panoramic view of what it takes to succeed in today’s legal profession—where knowledge alone is no longer enough.

Sunday Ndamugoba delivered a comprehensive perspective on what defines a well-drafted, airtight contract in today’s complex commercial environment. Speaking from his Tanzanian legal context, he emphasized the importance of clarity and precision in language, ensuring that contracts are free from ambiguity and clearly outline obligations, timelines, and deliverables. He stressed the need for contracts to comprehensively anticipate contingencies—incorporating breach clauses, remedies, dispute resolution mechanisms, and local realities such as dual languages and sector-specific compliance. Importantly, he urged lawyers to design contracts that are not only enforceable and legally sound, but also adaptable over time. He later explored the growing role of emerging technologies like AI in contract drafting, acknowledging their usefulness in automating standard clauses and conducting reviews, while warning of the risks they pose when used without oversight. He noted that AI should remain an assistant, not a decision-maker, especially in regions where regulatory frameworks are still developing. According to Ndamugoba, the responsibility of sound judgment, client-specific strategy, and contextual awareness remains squarely with the lawyer.

Dr. Pie Habimana brought energy and clarity to the topic of pitch-making. He challenged lawyers to move beyond the conventional definitions of good legal service and begin offering strategic value. According to him, storytelling is not simply a presentation tool, it is a transformative method that allows lawyers to make complex legal arguments relatable and persuasive. He underscored that clients are no longer seeking lawyers who merely know the law, they want advisors who understand their business and help them make smart decisions. A compelling pitch, he said, should help clients see not just the legal solution, but the strategic advantage.

The discussion then shifted to negotiation, where Asmahaney Saad shared an insightful perspective grounded in her experience as both a corporate lawyer and a mediator. She reminded participants that negotiation is an everyday skill, not just a professional tool, but a part of life itself. Her approach was deeply human: she encouraged lawyers to enter negotiations prepared, to recognize the difference between a client’s wants and their needs, and to always be aware of the emotional undercurrents in the room. Drawing on relatable stories, she demonstrated how listening, empathy, and flexibility often achieve far more than rigid demands. Saad also spoke to the modern lawyer’s role as a value-driven partner, not just a service provider—especially when negotiating fees or managing client relationships in an increasingly AI-influenced world.

Modeste Mulumba added depth to the conversation with his reflections on managing pressure during high-stakes negotiations. He spoke about the importance of staying mentally centered and methodical—especially when counterparties are aggressive or dismissive. He encouraged lawyers to approach each negotiation with a clear mind, to understand each party’s goals, and to guide discussions toward mutually acceptable outcomes without losing professional composure. Mulumba also emphasized the power of calm body language and professional demeanor, particularly when trying to de-escalate tense situations.

Together, these discussions painted a picture of a profession undergoing profound transformation. Lawyers today must be far more than technically proficient—they must be persuasive communicators, thoughtful negotiators, and adaptive advisors. As the speakers made clear, legal services are no longer judged solely by their correctness, but by the strategic value and clarity they deliver to clients.

This webinar offered more than just practical tips—it was a deep and timely reflection on the evolving identity of the legal profession

For more information, please click on the link to watch full video: https://www.youtube.com/live/hJ9hpUAOeaA

About Me

I love reading, writing, attending events, learning, leadership and meeting new people.

I hold a Masters Degree in International Law and I am passionate about life.

If you are interested in learning more about self discovery and becoming the best version of yourself.

Follow Me On

Subscribe To My Newsletter

Subscribe for new stories and exclusive content.