Hello, I am Advocate Brownie Ebal

I am a legal Practitioner, Venture Capitalist and Philanthropist.

Welcome to my site.

I love life, travelling, food, beauty, the law, leadership and meeting people from diverse backgrounds. I hope to inspire each one of you with my various articles as I share from my experiences around our beautiful world.

I live in Kampala, Uganda.

-

Article 70: The 5 Jars Principle: A Faith-Centred Approach to Financial Stewardship

Money is one of the earliest tools of independence most people encounter, yet it is rarely accompanied by wisdom on how to manage it well. For many young adults, income arrives before instruction, and financial decisions are made through trial, pressure, or imitation rather than intention. The result is often confusion, anxiety, debt, and a fractured relationship with money. The 5 Jars Principle offers a simple yet profound framework that restores clarity, discipline, and purpose to personal finance, while anchoring financial decisions in faith and values.

At its heart, the 5 Jars Principle is not merely a budgeting method; it is a stewardship mindset. It teaches that money is not owned absolutely, but entrusted. This perspective shifts the focus from consumption to responsibility, from impulse to planning, and from scarcity to purpose. By assigning every portion of income a role before spending begins, individuals learn to lead their money rather than react to it.

The principle is often taught using physical jars, especially for children and young adults, because it transforms an abstract concept into a visible, practical habit. Each jar represents a clear financial priority. As income is received, it is intentionally divided, reinforcing the idea that wise financial living is proactive, not accidental. Over time, this practice shapes character as much as it shapes bank balances.

When applied consistently, the 5 Jars Principle nurtures financial maturity by integrating faith, generosity, growth, preparation, and enjoyment into one coherent system. It recognises that financial health is not achieved by focusing on one area alone, but by maintaining balance across all aspects of life.

The five jars are introduced as follows.

The first jar is the Tithe Jar, which represents putting God first. This jar is set aside before anything else, affirming that God is the source of all provision. By honouring God with the first portion of income, individuals cultivate gratitude, humility, and trust. Scripture reminds us, “Honor the LORD with your wealth, with the firstfruits of all your crops” (Proverbs 3:9), and further affirms that “a tithe of everything… belongs to the LORD” (Leviticus 27:30). Tithing is therefore not framed as loss, but as alignment — a declaration that faith governs financial decisions. This practice trains the heart to depend on God rather than money and establishes spiritual order in personal finances.

The second jar is the Blessing Jar, dedicated to generosity towards others. This jar reflects the understanding that money is also a tool for compassion and community. Through intentional giving, individuals learn to look beyond themselves and recognise the needs around them. The Bible teaches, “Give, and it will be given to you” (Luke 6:38), and also assures us that “a generous person will prosper; whoever refreshes others will be refreshed” (Proverbs 11:25). Generosity builds empathy, strengthens relationships, and reminds us that wealth finds its highest purpose when it uplifts others. This jar guards against selfishness and nurtures a lifestyle of kindness and service.

The third jar is the Investing Jar, which focuses on long-term growth. Here, individuals are encouraged to think beyond immediate needs and pleasures, and to plan for the future with wisdom and diligence. Scripture affirms this principle clearly: “The plans of the diligent lead surely to abundance” (Proverbs 21:5), and “whoever gathers money little by little makes it grow” (Proverbs 13:11). Investing teaches patience, discipline, and responsibility. Whether through education, entrepreneurship, or structured investments, this jar equips individuals to grow resources steadily and sustainably over time.

The fourth jar is the Savings Jar, which prepares individuals for life’s uncertainties and opportunities. Saving is an expression of wisdom and foresight. The Bible uses the example of the ant to illustrate this truth: “Go to the ant, you sluggard; consider its ways and be wise” (Proverbs 6:6). It further states that “the wise store up choice food and olive oil” (Proverbs 21:20). By setting aside funds for emergencies or future needs, individuals avoid panic-driven decisions and unnecessary debt. This jar fosters peace of mind and reinforces the value of preparation.

The fifth and final jar is the Spending Jar. After honouring God, giving generously, investing wisely, and saving intentionally, individuals are free to enjoy what remains responsibly. Scripture affirms that enjoyment, when rightly ordered, is part of God’s design: “There is nothing better for people than to enjoy their work… this is a gift from God” (Ecclesiastes 3:13). This jar acknowledges that balance matters — life is meant to be lived fully, not anxiously. By placing spending last, the system ensures that enjoyment does not undermine stewardship, but flows from it.

What makes the 5 Jars Principle particularly effective is its simplicity. It is easy to understand, easy to teach, and easy to adapt to different income levels. More importantly, it works because it aligns behaviour with values. It removes ambiguity from financial decisions and replaces it with clarity. Every coin has a purpose, and every choice becomes intentional.

For young adults especially, this framework lays a strong foundation. It encourages living within one’s means, avoiding unnecessary debt, building financial resilience, and developing a healthy relationship with money early in life. Over time, the jars may change in size as income grows, but the principles remain constant.

Ultimately, the 5 Jars Principle reminds us that financial wisdom is not separate from spiritual life. How we manage money reflects what we value, what we trust, and what we prioritise. When finances are stewarded with intention and faith, they become a source of peace rather than pressure, and a means of purpose rather than anxiety.

Wise stewardship is not about how much we earn, but how faithfully we manage what we receive.

For further reading and additional perspectives on the 5 Jars Principle:

-

Article 68: Navigating Emotional Wellness of a Woman in the Workplace.

On 6th March, 2025, the Parliament of Uganda hosted a Zoom discussion under the theme “Navigating Emotional Wellness of a Woman in the Workplace.” The session aimed to equip women with strategies for managing emotions, maintaining balance, and fostering resilience in professional spaces. The panel featured Lindsay K. Nzeyi, Executive Director of Break Free Treatment & Rehabilitation Center; Gabriel Kagume, Financial Literacy and Masterclass Trainer; and Rose Ikiror Semakula, Deputy Clerk – Parliament Affairs.

The discussion highlighted the emotional struggles women face at work, how external pressures influence professional well-being, and the steps women can take to maintain balance.

Workplace stress is not always a result of professional responsibilities alone. Emotions from outside work—such as personal struggles, family obligations, or financial pressures—can spill into the workplace, affecting concentration and performance. Unresolved personal issues may also manifest in professional interactions, leading to conflicts or emotional exhaustion.

Burnout is another common challenge, often caused by excessive workloads, competition for promotions, or the pressure to meet financial obligations. Taking on too many responsibilities beyond one’s capacity can lead to exhaustion, reduced productivity, and loss of enthusiasm for work. Financial insecurity further contributes to emotional strain, especially when individuals feel pressured to overwork in order to meet financial demands.

Below are some of the recommended solutions;

- Expressing oneself openly: Confidence in communication is essential for a healthier workplace experience. Addressing concerns, seeking support, and articulating professional needs can help create a more balanced work environment.

- Acknowledging and managing emotions: Recognizing how emotions impact performance allows for better regulation. Strategies such as journaling, seeking mentorship, or practicing mindfulness can be useful in processing emotions constructively.

- Setting boundaries: Taking on excessive workloads does not always guarantee success. Prioritizing core responsibilities and maintaining a sustainable work pace can help prevent burnout.

- Developing financial independence: Financial stress can be managed through budgeting, financial literacy education, and exploring additional income sources. Books such as How Come That Idiot Is Rich and I Am Poor? and Where Did My Money Go? were recommended for better financial management.

- Building a strong support system: Consulting the right people for both personal and professional advice provides valuable guidance and helps in navigating workplace challenges more effectively. Seeking mentorship, professional networks, or trusted individuals with relevant experience can offer meaningful support and perspective.

- Focusing on personal growth: Defining individual goals and staying committed to them ensures a more fulfilling career path rather than engaging in unnecessary competition.

- Resilience: Emotions are a natural part of life, but knowing when and how to react is crucial. Practicing composure in challenging situations, maintaining humility, and taking responsibility for personal success all contribute to emotional wellness.

In conclusion, the discussion reinforced the importance of emotional awareness, financial stability, and effective communication in maintaining workplace well-being. Navigating emotional wellness requires setting boundaries, managing stressors constructively, and fostering resilience. By applying these strategies, a balanced and fulfilling work experience can be achieved.

-

Article 67: The Intelligence Trap: 7 Mistakes Smart People Make

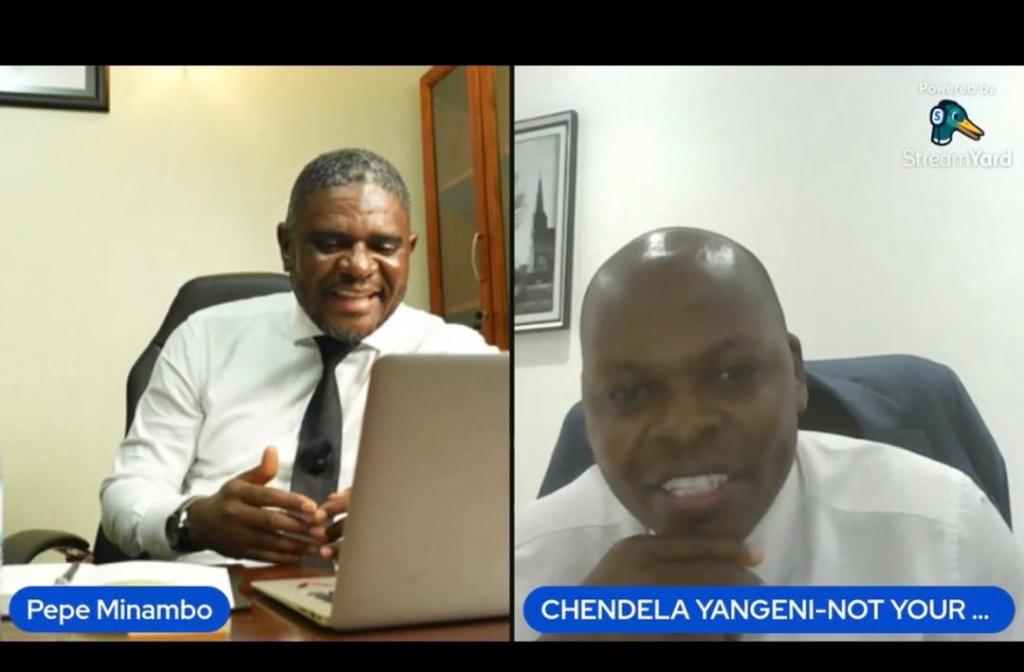

On 28th August, I joined a LinkedIn Live hosted by Pepe Menambo with guest Mr. Yengeni, reflecting on a theme that was as sobering as it was insightful: The Intelligence Trap—Seven Mistakes Smart People Make.

At first glance, this might sound like a conversation only for top executives, but as Mr. Yengeni emphasized, “We are all smart.” Every contribution at work, every idea born in our minds, is evidence of intelligence. The question is not whether we are smart, but whether our intelligence is working for us or against us.

The discussion unpacked several common traps:

1. Relying on intelligence alone.

Being smart is valuable, but intelligence does not thrive in isolation. Many successful CEOs understand this, which is why they negotiate for room to build the right teams and bring in critical talent. Brilliance without a support system risks being wasted, while intelligence combined with the right environment creates impact.

2. Working hard in silence.

A common trap is believing that hard work alone will speak for itself. Someone may write an excellent report but never step into the boardroom where decisions are made. As Yengeni put it, “You cannot sell a secret. The mouth that keeps quiet never gets help.” Competence needs visibility; otherwise, opportunities remain out of reach.

3. Overusing strengths.

What begins as a strength can become a weakness if not managed well. Being articulate is useful, but talking too much in an interview can overshadow the very message you want to pass across. In the same way, posting endlessly on social media can weaken your personal brand rather than strengthen it. Strategy, moderation, and timing keep strengths effective.

4. Becoming trapped by hard work.

Sometimes, working too well at your job makes you so valuable to your boss that you cannot easily be promoted or released. It is possible to spend 15 years in one company and only move two steps up because you were always too busy working on the job, not on yourself. Hard work needs to be balanced with self-investment and a deliberate career plan.

5. Undervaluing yourself in salary negotiations.

One of the most common mistakes is answering “anything” when asked about expected pay. This reflects a lack of self-worth. Researching market standards and knowing your value allows you to negotiate confidently. The panelists noted that the first five years of a career are for learning, but between five and ten years, it’s also about earning.

6. Over-profiling or misbranding.

In the effort to appear impressive, some professionals overstate their profiles—labeling themselves as “Founder” or “CEO” while still seeking entry-level roles. This creates confusion and may even close doors. A profile should be precise and aligned with the stage you are in, not one that sends the wrong signals.

The conversation made it clear that the “intelligence trap” is not about a lack of brilliance but about how brilliance, when unchecked, turns into a stumbling block. From being too quiet to being too loud, from undervaluing to over-inflating ourselves, these mistakes can undermine even the smartest among us. The true measure of intelligence, therefore, is not just being smart, but being strategic in how that intelligence is applied.

-

Article 66: The Power of Words: Mastering Communication for Impact, Confidence, and Connection.

In an age driven by constant interaction online and offline, few skills are as powerful, or as underappreciated, as the ability to communicate with confidence. This truth sits at the heart of a remarkable conversation between motivational speaker and bestselling author Mel Robbins and trial attorney turned viral communicator Jefferson Fisher, featured on the Mel Robbins Podcast.

Fisher, a practicing lawyer with millions of followers across social platforms, has built a reputation for teaching people how to speak with clarity, authority, and empathy, from the front seat of his car, no less. But this is not just another talk about “talking better.” This is about using your words to transform your relationships, your presence, and your life.

“What you say is who you are,” Fisher asserts. “Most people will never experience you beyond the words you speak.” That idea is both empowering and sobering. It means your tone, your intention, and your delivery are not just part of your message—they are your message.

One of the most powerful lessons from this conversation is that good communication is not about saying more—it is about saying what matters, with purpose. Whether dealing with tension in a marriage, navigating awkward family dinners, or facing difficult conversations at work, Fisher encourages a posture of curiosity, not defensiveness. Instead of reacting with “Why did you say that?” he suggests we pause and ask, “What did you hear?” This small shift opens the door to understanding, not argument.

Fisher also challenges the belief that being kind is being weak. In his words, kindness is clarity delivered with respect. You can be honest and direct, while still being compassionate. When delivering tough feedback or navigating conflict, he recommends framing it with affirming language: “I am telling you this because I know you can handle it.” It is a way of honoring the person in front of you while holding the conversation to a higher standard.

More than tactics, though, Fisher invites us to lead with values. He speaks of personal “conversational values” that keep him grounded—guiding every interaction. Values like: if I cannot be a bridge, I will be a lighthouse; if there is room for kindness, I will use it; let my words show who I am, even if they do not know my name. These internal commitments shape not just what we say, but who we become in the process.

Ultimately, this conversation is a reminder that we do not need more noise—we need more intention. The next conversation you have is not just another exchange. It is a mirror of who you are, a seed of your legacy, and a chance to shape the world around you.

For more information, watch the full episode here: https://youtu.be/ZUCB3M_1Qp4

About Me

I love reading, writing, attending events, learning, leadership and meeting new people.

I hold a Masters Degree in International Law and I am passionate about life.

If you are interested in learning more about self discovery and becoming the best version of yourself.

Follow Me On

Subscribe To My Newsletter

Subscribe for new stories and exclusive content.