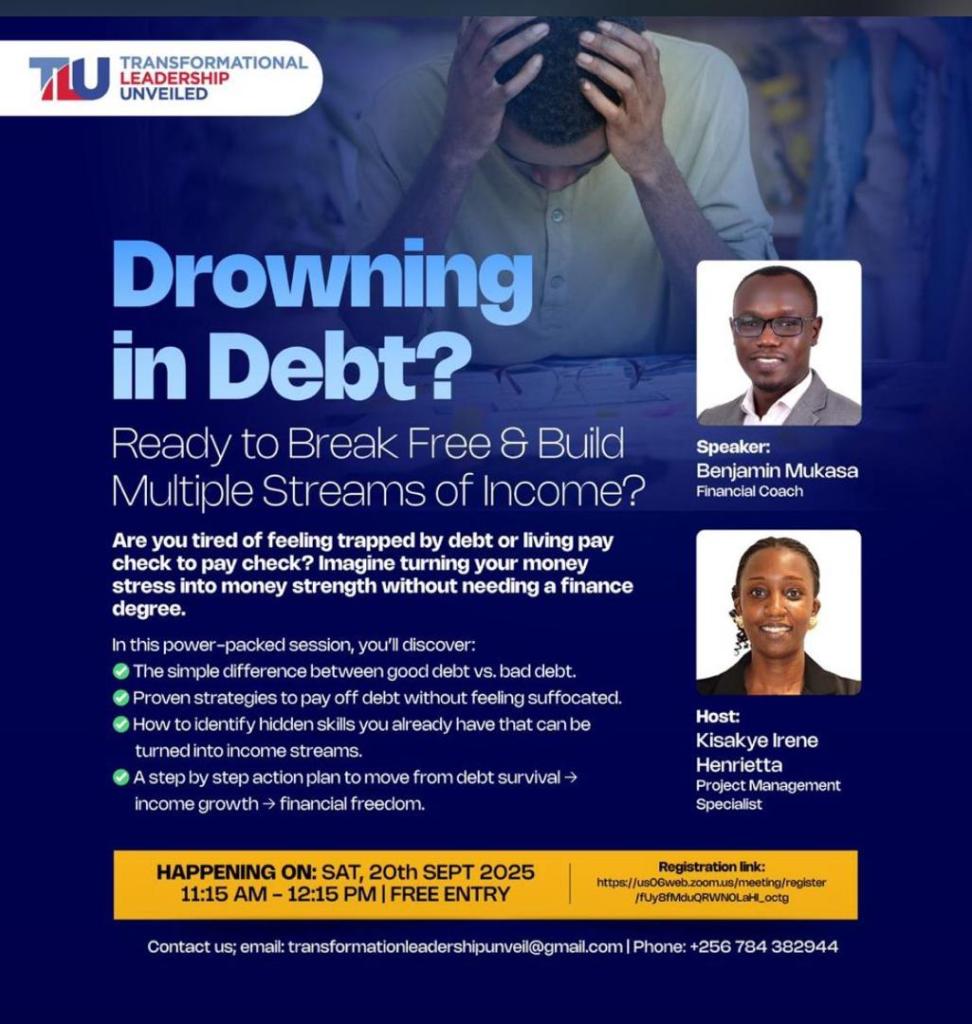

On 20th September, financial educator Benjamin Mukasa led an insightful Zoom session on one of the most pressing topics today: debt. Far from being just a burden, debt was unpacked as a double-edged tool, capable of building wealth if managed wisely, but equally capable of trapping individuals in financial bondage if misused.

Benjamin began by grounding the discussion in the basics: what is debt? At its core, it is simply money borrowed today against future income. But whether this borrowed money turns into opportunity or stress depends entirely on how it is used. Good debt, he explained, is channeled into assets or investments that generate income or appreciate in value—education, business loans, or mortgages. Bad debt, on the other hand, funds consumption and liabilities, like borrowing for luxury cars, expensive weddings, or the latest gadgets.

He painted a vivid picture of the debt spiral: overspending leads to borrowing, which leads to more borrowing, and soon, stress and financial pressure become a way of life. Breaking free requires discipline and strategy. Two proven approaches were outlined: the Snowball Method (clearing smaller debts first for motivation) and the Avalanche Method (tackling the highest-interest debts to save money in the long run).

The conversation then broadened to breaking free from debt and creating financial resilience. Participants were encouraged to:

- Audit spending and track every shilling to avoid “small leaks” that drain resources.

- Negotiate wherever possible—from school fees to loan interest rates.

- Diversify income streams by turning hidden skills into cash flow opportunities, whether baking, tutoring, or bookkeeping.

A critical reflection also came up: Is it valid to say that it’s easier to build wealth with debt than through saving? Benjamin explained that the statement carries much weight. With debt, one can take action earlier—such as starting a business today instead of waiting years to save up. Debt also adds urgency: because repayment is mandatory, people tend to put in more energy and focus to ensure success. In contrast, savings come with less pressure, which can sometimes lead to slower execution. Yet, he cautioned, debt only works when used responsibly. Mismanaging it—like diverting a loan into personal expenses—can turn it into a trap.

The session closed with a powerful reminder: “Debt is not the end of your story. It is simply a chapter. And chapters can change. What matters are the choices you make from this point forward.”

Leave a comment