On the 19th August 2025, the East African Law Society hosted a webinar on Mergers and Acquisitions (M&A) in East Africa: Emerging Trends, Regional Dynamics, and Global Influences. The event convened top legal practitioners, corporate leaders, and regulators to unpack the opportunities, risks, and future of deal-making in the region.

Mr. Steven Tumwesigye, Managing Partner at TASLAF Advocates, set the pace by highlighting how startups and mid-sized enterprises are using M&A as a tool for consolidation and growth. He pointed to healthcare deals such as MyDawa’s acquisition of Guardian Health and Rocket Health’s expansion into telemedicine as signs of consolidation in a sector driven by digital

penetration. He noted that consolidation in agriculture, retail, and ICT is increasingly attractive to investors, provided companies maintain clean books, strong contracts, and formal governance. He emphasized that lawyers have a central role in due diligence, structuring, tax advisory, and

harmonizing employment obligations, stressing that partnerships with innovation hubs and accelerators help prepare young businesses to be merger-ready.

Ms. Catherine Kariuki, Partner at Cavendrys Advocates, expanded on the regional fintech and technology ecosystem, which she described as one of East Africa’s most vibrant. She recalled Nigeria’s Co-Creation Hub acquiring Kenya’s iHub as a strategic move that combined talent, intellectual property, and community. Catherine explained that most fintech acquisitions are

motivated by the need to acquire existing licenses and infrastructure rather than building from scratch, citing IFC’s $100 million investment into Raxio data centers and KCB’s acquisition of RiverBank Solutions as clear signals of investor preference. She stressed that lawyers must anticipate multi-layered approvals, from central banks to competition regulators, and integrate

these into deal timelines. Policy-sensitive examples, such as the challenges surrounding Telkom Kenya’s ownership changes, underscored her call for careful structuring, robust documentation, and clarity on regulatory obligations.

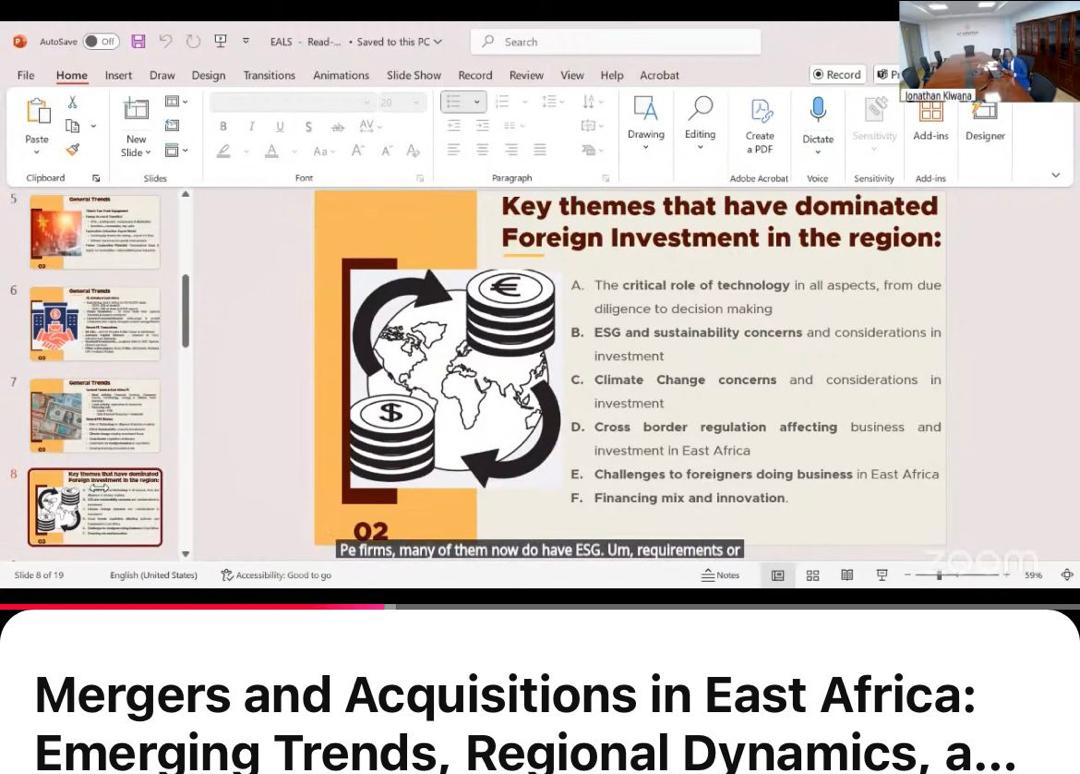

Mr. Jonathan, Senior Associate at AF Mpanga Advocates, presented insights on global capital inflows and their influence on East African M&A. He contrasted European private equity firms’ strong presence in consumer goods, renewable energy, and financial services with China’s focus

on infrastructure and extractives. Notable examples included Access Bank’s expansion across East Africa and Equity Bank’s move into Congo and Rwanda. Jonathan highlighted that technology is reshaping M&A transactions through AI-enabled contract reviews, digital data rooms, and ESG-driven due diligence. He emphasized that investors now assess climate-conscious and socially responsible practices as part of deal viability. For lawyers, he underlined the importance of continuous upskilling, building approvals calendars to navigate cross-border regulations, and mastering project management to coordinate multi-advisory teams.

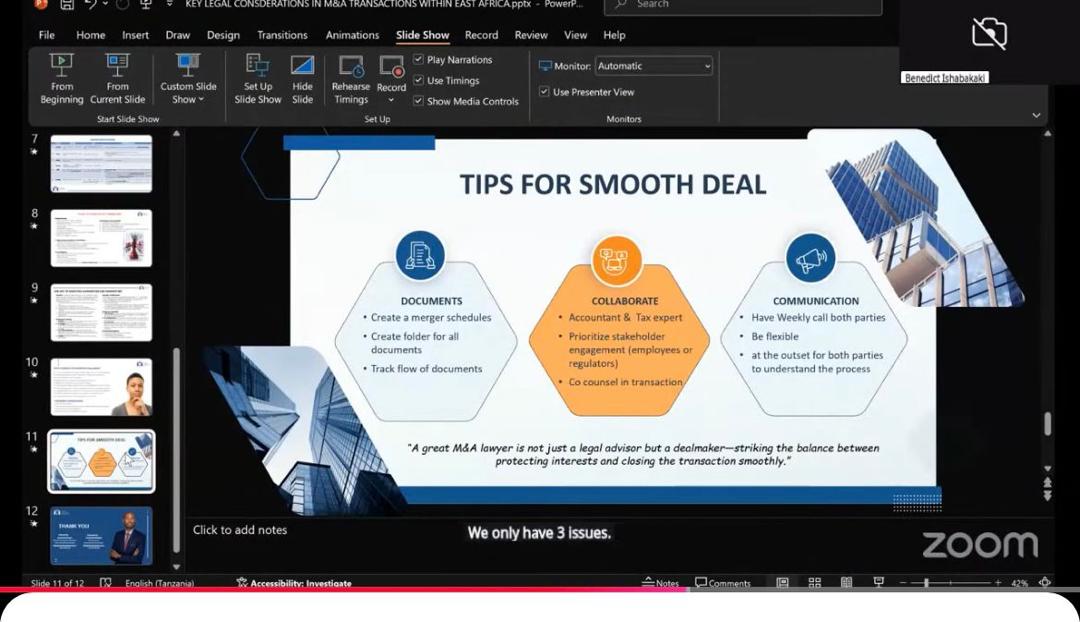

Mr. Benedict Ishabakaki, Executive Partner at Victory Attorneys & Consultants, delivered a practical session on deal structuring, where he emphasized that successful M&A transactions depend on three key tips: thorough documentation and record-keeping, strong collaboration with

other professionals such as accountants and tax experts, and consistent communication among all parties involved. He distinguished between share purchase agreements and asset purchase agreements, noting that while share deals provide continuity and brand leverage, they also

transfer liabilities. Drawing on experience in banking, gaming, and retail acquisitions, he advised treating M&A transactions as projects that require multidisciplinary collaboration with tax, labor, corporate, and litigation experts. He cautioned against insufficient due diligence, overlooking tax

implications, and weak indemnity clauses, which can expose clients and counsel to significant risks. Benedict stressed that rather than discouraging clients from investing in weak compliant companies, lawyers should craft strong warranties, indemnities, and conditional completion mechanisms to safeguard investors.

Ultimately, the discussions showed that M&A in East Africa is a powerful tool for growth and resilience, and its success will depend on innovation, collaboration, and strong legal and regulatory frameworks.

Leave a comment