Written by Adv. Brownie Ebal

Financial freedom is more than just having money in the bank—it is about peace of mind, flexibility, and the ability to make life decisions without being held back by debt or constant financial pressure. It means choosing how you spend your time, where you work, and how you live, with money as a tool—not a trap.

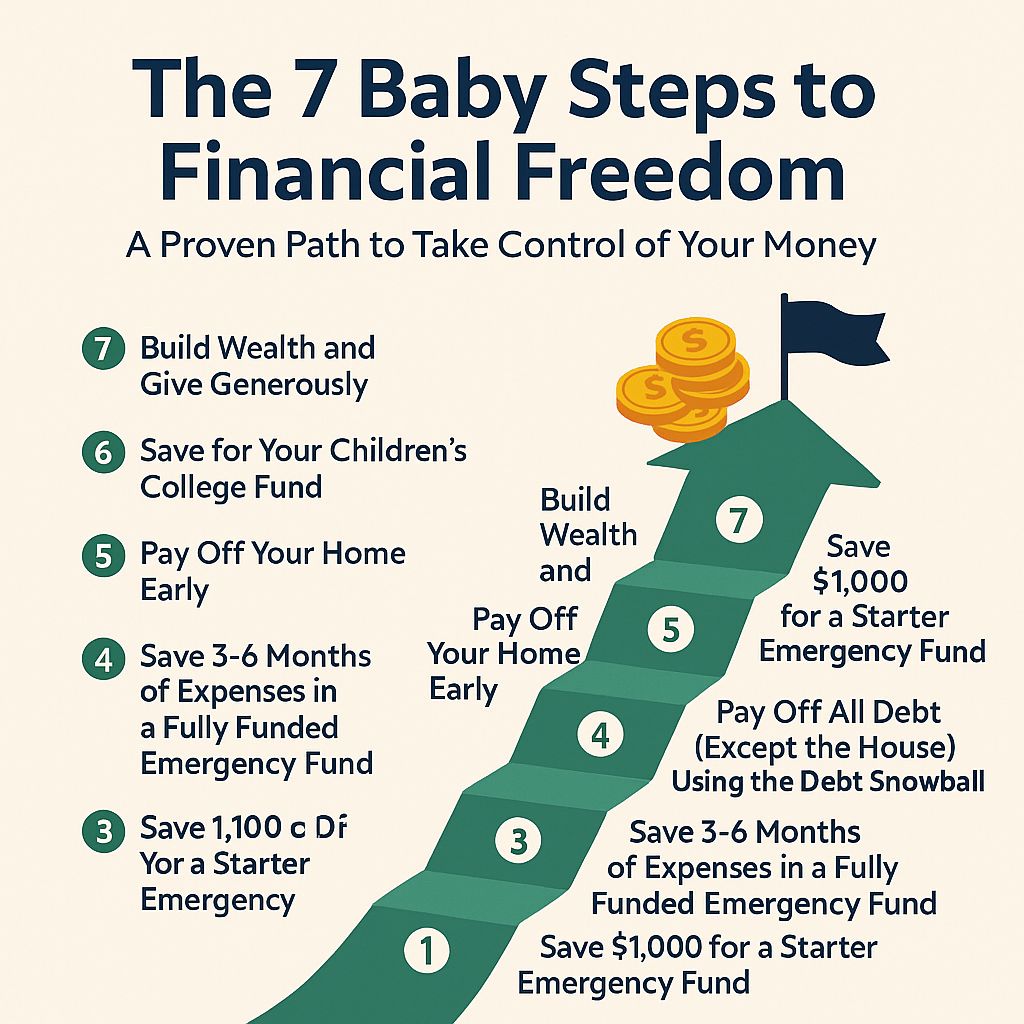

One of the clearest and most effective roadmaps to achieving financial freedom is Dave Ramsey’s 7 Baby Steps. These steps are simple, but not easy. They demand discipline, intentionality, and a mindset shift. But they have helped millions, and after watching the video, it is clear why they work: not just mathematically, but behaviorally.

Here is how they unfold:

Step 1: Save UGX 3.5 million (~$1,000) for a Starter Emergency Fund

Before focusing on paying off debt, your first goal should be setting aside a modest emergency fund. This cushion protects you from everyday surprises like a car breakdown or sudden medical expense—without turning to mobile loans or overdrafts. For liquidity and ease of access, consider keeping this emergency fund in a unit trust (unit fund) rather than a traditional bank savings account.

Unlike banks that typically offer very low interest rates on savings accounts, unit trusts invest your money in a diversified portfolio, potentially yielding better returns. They also maintain relatively quick access to your money. I personally recommend UAP Old Mutual Unit Trust—it is what I use. They issue regular statements and offer prompt withdrawals, making it an excellent option for an emergency fund. For more information, visit: https://www.uapoldmutual.co.ug

Other reputable unit trust providers in Uganda include:

- Sanlam Investments East Africa: https://invest-ug.sanlameastafrica.com

- Xeno Investment Management : https://myxeno.com

- ICEA Lion Asset Management: https://icealion.co.ug

- Britam Asset Managers: https://ug.britam.com

Kindly check them out and choose one that aligns with your investment goals and customer service expectations.

Step 2: Pay Off All Debt (Except Your Mortgage) Using the Debt Snowball Method

List all your non-mortgage debts—such as salary loans, mobile money loans (e.g., Airtel Money or MTN MoMo advances), SACCO loans, or credit card balances—from smallest to largest. Focus all your extra money on clearing the smallest debt first while making minimum payments on the rest. Each win gives you momentum and builds your confidence. In Uganda, where access to quick but costly credit is widespread, this step is crucial for breaking the debt cycle.

Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

Once you are debt-free (except your house), it is time to beef up your emergency fund. This fund should cover basic living expenses like rent, food, transport, and utilities for at least three months. If you lose your job or face a major crisis, you will have time and breathing space to recover without panic. Again, UAP Old Mutual or other low-risk money market accounts are excellent places to store this fund with access and security in mind.

Step 4: Invest 15% of Your Household Income Toward Retirement

With your safety net in place, shift your focus to long-term wealth. In Uganda, one of the best tools available is NSSF (National Social Security Fund). If you are self-employed or in the informal sector, consider making voluntary NSSF contributions—you can register easily through the NSSF Go App or visit their branches. You can also visit their website: https://www.nssfug.org for more information. In addition, explore treasury bills and bonds offered by the Bank of Uganda as stable, passive-income investment options. These instruments are secure and can yield higher returns than savings accounts over time.

Step 5: Save for Your Children’s Education

If you have children, start setting aside money for their school fees or university education. Open a dedicated education fund—many insurance companies in Uganda offer education policies with guaranteed payouts and optional life coverage. Alternatively, earmark some of your investments in treasury bonds to mature in time with your child’s academic milestones.

Step 6: Pay Off Your Home Early

Once your debts are clear, emergency fund set, and retirement and education plans are in motion, focus on eliminating your mortgage. In Uganda, this could be a loan from Housing Finance Bank or another institution. Paying off your home early saves millions in interest and gives you true financial freedom—no more rent or housing stress.

Step 7: Build Wealth and Give Generously

With no debt, a fully funded emergency reserve, ongoing investments, and a paid-off home, you are in a position to live and give with purpose. Support your church, community projects, or family in need. Generosity becomes a joy when your finances are in order—and it has a multiplying effect in society.

In conclusion, financial freedom is not just about money—it is about peace, control, and confidence. Dave Ramsey’s 7 Baby Steps offer a straightforward, actionable plan for anyone ready to take control of their finances and their future. It’s not always easy, but it is simple. And best of all—it works.

As Dave often says: “Live like no one else now, so later you can live and give like no one else.”

For more information on investments:

Joseph Areu- 0778171804

Referral: Brownie Ebal

Watch the video here to start your journey:https://youtu.be/lGHGzU3CtZg?si=RpgQIGfnCsfyVado

Leave a comment